Bitcoin has followed Wednesday’s increases on Wall Street and has risen to about ,400. Most altcoins are also in green, as the total market cap sees a billion addition over the past day.Ethereum, Polkadot, and Chainlink surge by approximately 10%, while DeFi tokens lead the way with the most gains, as YFI touches the 3 BTC mark once again.ETH Above 0The altcoin market sustained some severe losses in the past week. Nevertheless, they are displaying signs of recovery today, with green being the predominant color. Ethereum is up by 10% to above 0, while Ripple increases by 4% to nearly %excerpt%.25.Chainlink defends its top-5 position by a 10% surge to . However, Bitcoin Cash (2.2%) and Polkadot (10.5%) are still breathing down LINK’s neck. Binance Coin (BNB) is up by 4.5% and

Topics:

Jordan Lyanchev considers the following as important: AA News, AMPLBTC, AMPLUSD, AMPLUSDT, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, defi, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, THETABTC, THETAUSD, Wall Street, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin has followed Wednesday’s increases on Wall Street and has risen to about $10,400. Most altcoins are also in green, as the total market cap sees a $22 billion addition over the past day.

Ethereum, Polkadot, and Chainlink surge by approximately 10%, while DeFi tokens lead the way with the most gains, as YFI touches the 3 BTC mark once again.

ETH Above $370

The altcoin market sustained some severe losses in the past week. Nevertheless, they are displaying signs of recovery today, with green being the predominant color. Ethereum is up by 10% to above $370, while Ripple increases by 4% to nearly $0.25.

Chainlink defends its top-5 position by a 10% surge to $13. However, Bitcoin Cash (2.2%) and Polkadot (10.5%) are still breathing down LINK’s neck. Binance Coin (BNB) is up by 4.5% and Litecoin by 3%.

The most impressive gains are evident from DeFi-related coins, which suffered the most in the past week. Ampleforth leads the way with a 75% surge to $1.15, whereas the AMPL holders are expecting a positive daily rebase for the first time in a while. Solana (55%), Yearn.Finance (38%), Loopring (30%), Aave (28%), and Ren (28%) are next.

SushiSwap’s governance token (SUSHI) gains 27% after moving forward with the migration of the liquidity locked on the protocol. So far, it appears that SushiSwap is winning the liquidity war with Uniswap.

Numerous other alts represent the double-digit pump club. Those include Algorand (24%), Hyperion (22%), Synthetix Network (21%), BitShares (21%), DFI.Money (20%), THETA (18)%, and more.

The bottom line is that the total market cap has surged by $22 billion from yesterday’s bottom at $317 billion to nearly $340 billion.

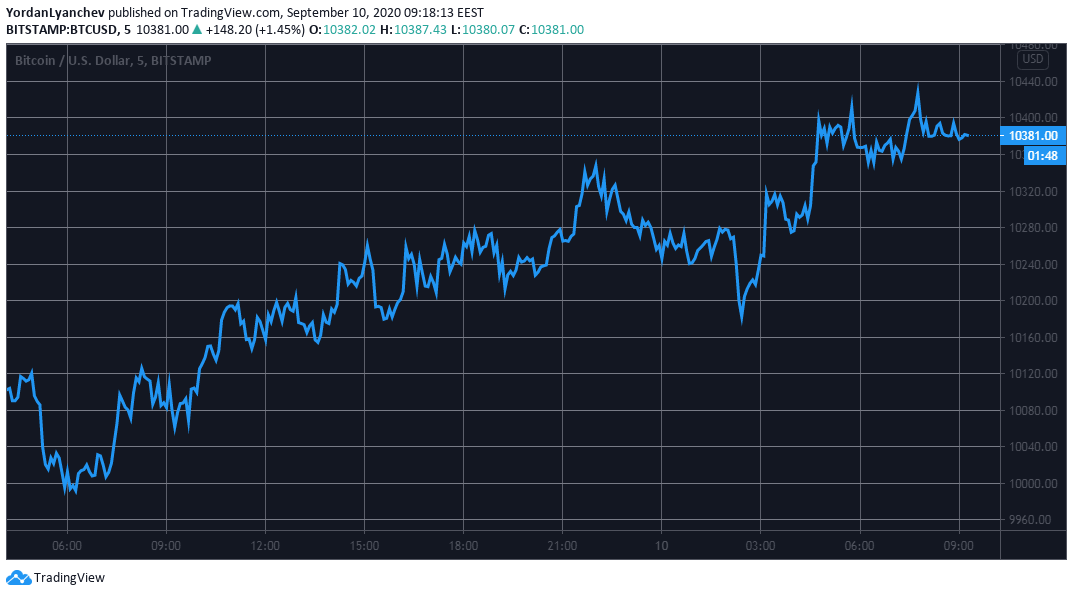

Bitcoin Follows Wall Street and Gold: BTC Defends $10K

The primary cryptocurrency dropped below $10,000 once again yesterday. However, the bulls didn’t allow any further declines, and Bitcoin bulls have successfully won the $10K battle, as it seems now. As of now, the coin reached the $10,400 resistance as the daily high.

Consequently, BTC’s market cap has increased as well to above $192 billion. Yet, the more impressive gains from the altcoins have reduced Bitcoin’s dominance. The metric comparing BTC’s market cap with all alts has dropped to 56.5% after reaching 59% earlier this week.

It’s worth noting that yesterday was a highly positive trading day for most financial markets. The most prominent US stock market indexes recovered to some extent from the recent losses. The S&P 500 closed with 2% gains, the Dow Jones Industrial Average with 1.6% and Nasdaq went up by 2.7%.

Gold price also increased from its intraday low of $1,920 per ounce to over $1,945. As CryptoPotato reported yesterday, the 60-day correlation between the precious metal and Bitcoin has reached a fresh all-time high, despite signs of decoupling in the past few weeks.