The cryptocurrency market plunge started during the weekend and continues as of writing these lines. Bitcoin dumped with over 15%. Naturally, the general sentiment among the crypto community has changed. Some speculate that the 2020 bullish trend is now over and that investors should prepare for even worse consequences.Market Sentiment Follows The PriceIt’s safe to say that the cryptocurrency market has seen better times. In a matter of three days, the total market capitalization went from 4B down to a low of 3B, marking a plunge of over 15%.As it happens regularly, the general sentiment within the community followed the most recent price developments.According to the crypto monitoring resource, Santimentfeed, public opinion has turned to excessive negativism. By tracking keywords of

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Bear Market, Editorials

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The cryptocurrency market plunge started during the weekend and continues as of writing these lines. Bitcoin dumped with over 15%. Naturally, the general sentiment among the crypto community has changed. Some speculate that the 2020 bullish trend is now over and that investors should prepare for even worse consequences.

Market Sentiment Follows The Price

It’s safe to say that the cryptocurrency market has seen better times. In a matter of three days, the total market capitalization went from $264B down to a low of $223B, marking a plunge of over 15%.

As it happens regularly, the general sentiment within the community followed the most recent price developments.

According to the crypto monitoring resource, Santimentfeed, public opinion has turned to excessive negativism. By tracking keywords of cryptocurrency-related discussions, they have concluded that the mentions of “sell,” “selling,” and “sold” have skyrocketed on most social media platforms. Santimentfeed uses social networks such as Telegram, Reddit, Professional Traders Chat, Twitter, and Discord.

The research also outlined that the last time such negative discussions were reaching that popularity level was back in November 2019. At that point, Bitcoin lost over $1,000 of its value in just a few hours when China emphasized that cryptocurrencies are still illegal.

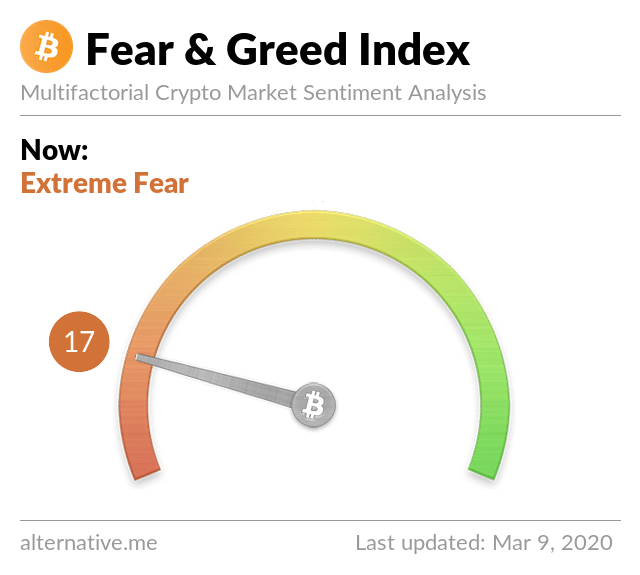

Fear & Greed Index: Extreme Fear

The Fear and Greed index confirms the dominant pessimistic sentiment. It measures and aggregates various types of data, including volume, social media, surveys, BTC dominance, and volatility, to establish the current feeling in the market. It provides the perspective from 0 (extreme fear) to 100 (extreme greed).

At the time of this writing, the index points on 17 – noting the mainly fearful state, or “Extreme Fear.” Only yesterday, before the sharper part of the recent price dump, it was at 37, and a week ago was at a neural state – around 50. It shows, once again, how quickly the situation might change.

Opportunity?

Even though the current situation looks unfavorable, to say the least, the general public sentiment doesn’t always act as a valid price indicator. In fact, the market usually tends to move in the opposite direction to the public opinion as it did in mid-December 2019. This is mainly because most traders will lose over time, and the ‘whales’ know this valuable info and act accordingly.

In comparison to December 1019, the F&G Index was pointing at “extreme fear.” Bitcoin was trading at about $6,500, and most people believed that it would bottom below $6,000, or even revisit $4400 and $5000. However, only hours later, the price of Bitcoin soared by $1,000.

Someone once said, “When everyone fearful, be greedy.” That was one of the most successful investors – Warren Buffet.

Santimentfeed concluded that whenever the main sentiment becomes exceptionally pessimistic, “a price bounce generally follows historically.”