The cryptocurrency market has lost billion from its market capitalization, as the majority of cryptos in the red over the past 24 hours. Bitcoin’s current weekly low is at ,100, while Ethereum reached the target of 0 as predicted by CryptoPotato.The giant blockchain, Polkadot, is trading around .40 after the DOT token was added to major exchanges earlier this week at a price of . DOT is recording a fantastic ROI of more than 80% over the past four days of trading. Polkadot is now the 7th largest project by market cap, according to CoinGecko. The reason for the DOT excitement might be the upcoming split of 1:100.Bitcoin Loses 0 DailyAfter a few days of stagnant price action, the primary cryptocurrency made a decisive move in the past 24 hours. Bitcoin price went from its

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BSVBTC, BSVUSD, BTCEUR, BTCGBP, btcusd, btcusdt, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, polkadot, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The cryptocurrency market has lost $20 billion from its market capitalization, as the majority of cryptos in the red over the past 24 hours. Bitcoin’s current weekly low is at $11,100, while Ethereum reached the target of $370 as predicted by CryptoPotato.

The giant blockchain, Polkadot, is trading around $5.40 after the DOT token was added to major exchanges earlier this week at a price of $3. DOT is recording a fantastic ROI of more than 80% over the past four days of trading. Polkadot is now the 7th largest project by market cap, according to CoinGecko. The reason for the DOT excitement might be the upcoming split of 1:100.

Bitcoin Loses $700 Daily

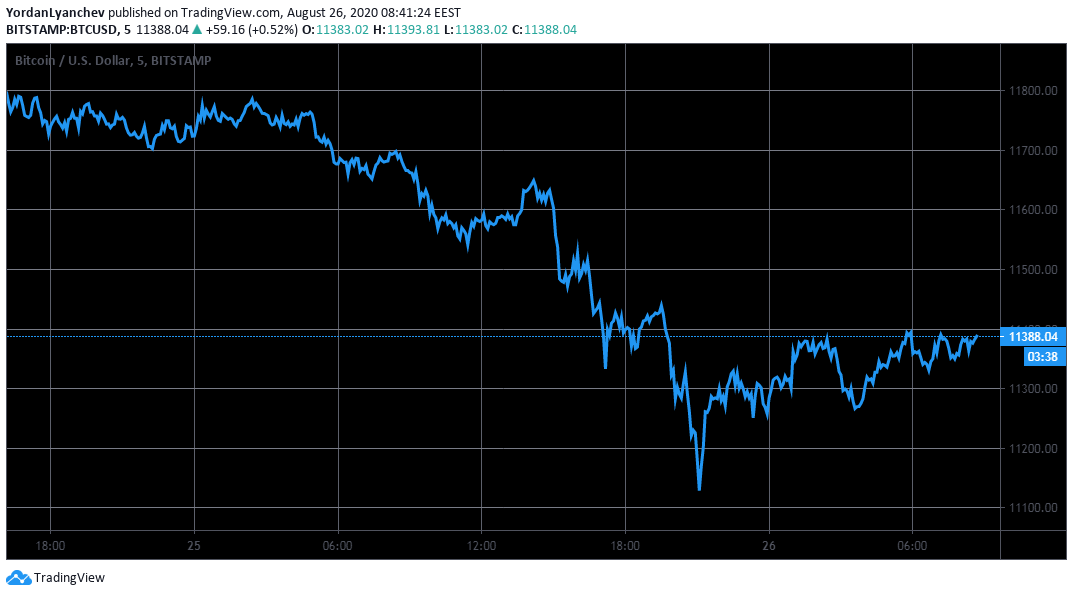

After a few days of stagnant price action, the primary cryptocurrency made a decisive move in the past 24 hours. Bitcoin price went from its daily high of approximately $11,800 to its bottom at $11,100 in just a few hours.

Although BTC recovered from the daily low and now trading beneath the $11,400 support turned resistance, the asset is still down by more than 2% since yesterday. On a broader scale, Bitcoin has lost more than $1,000 since it reached its new yearly high of $12,450 about a week ago.

Interestingly, the support at $11,100, which currently seems to save BTC from further losses, also rescued the asset during the August 11th crash. However, the cryptocurrency breaks below it, BTC will likely have to rely on the psychological line at $11,000, before potentially dipping to the previous 2020 high at $10,500.

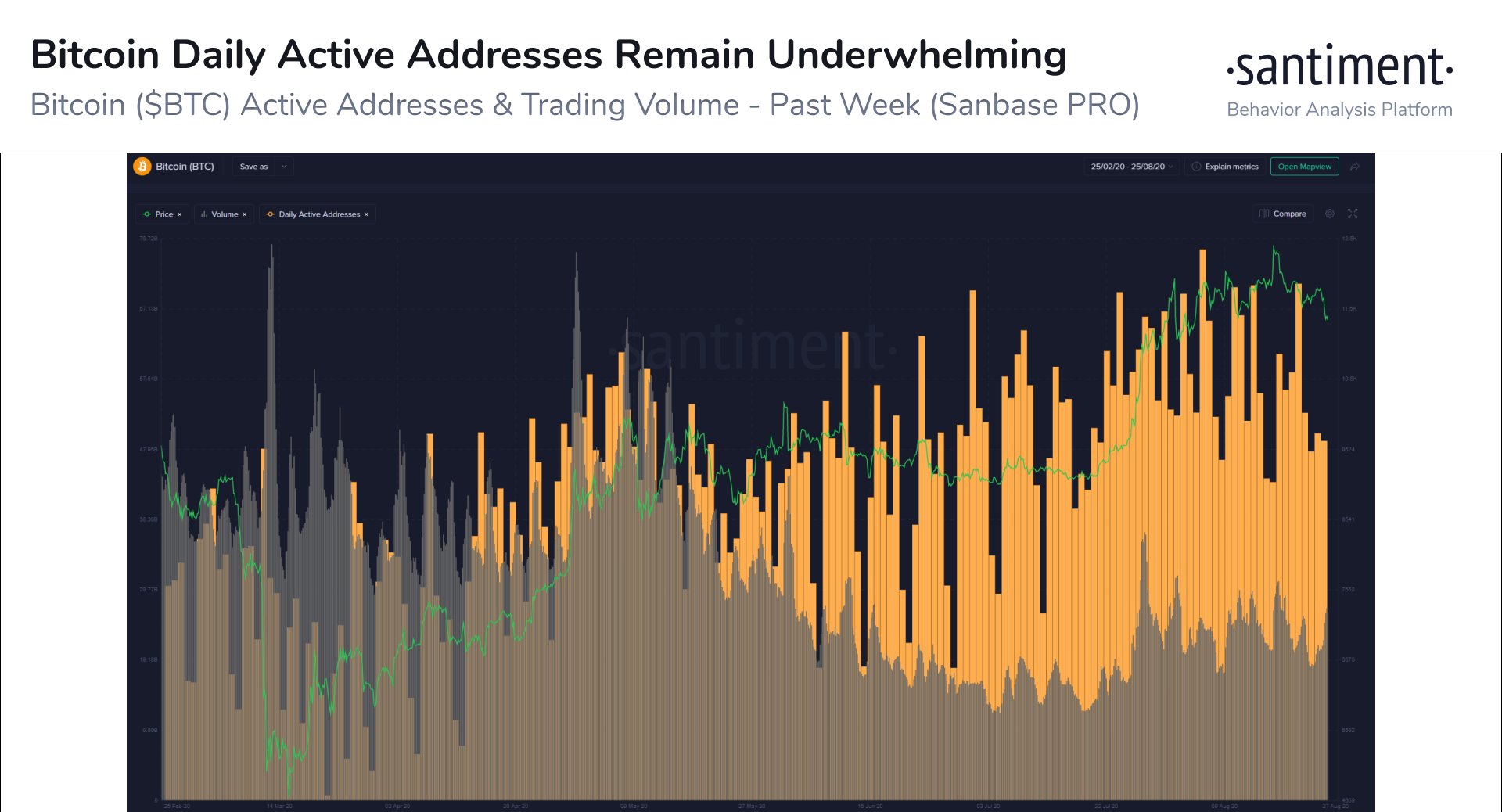

According to the data analytics company Santiment, Bitcoin’s drop may not be a surprise. By exploring the decreasing daily active addresses, the firm concluded that BTC’s “-3.7% price was surely related to this metric’s -19.3% decline since its peak of 1.13 million active addresses back on August 6th.”

As it frequently happens lately, Bitcoin and gold present a correlating price performance. The precious metal is also down over the past 24 hours: From its intraday high of $1,940 per ounce its current position below $1,920.

Altcoins Bleed Out With A Few Exceptions

Bitcoin dragged most alternative coins down as well, with the entire market cap tanking from $370 billion to $350 billion.

Ethereum couldn’t maintain its position above $400 for long, and the second-largest digital asset dipped to $370 before recovering its bounce. Ripple is down by 3% to below $0.28. Chainlink (-3%) to $14.5, Bitcoin Cash (-4%) to $275, Litecoin (-5%) to $58, BitcoinSV (-4%) to $195, and Cardano’s 8% decline has taken ADA out of the top 10.

The most substantial losers come from lower-cap alts with Flexacoin (-15%) in the lead, followed by Nervos Network (-10%), Verge (-9%), Ocean Protocol (-9%), and OMG Network (-9%).

Although most of the market is in red, there are a few exceptions – Kusama is 32% up, Aragon (16%), The Midas Touch Gold (13%), Aave (12%), and OKB (9%).