Cryptocurrency prices are quite susceptible to news, according to a recent paper. While, somewhat unsurprisingly, adverse announcements lead to immediate sharp declines, the establishment of clear regulations tends to mark serious market gains.Crypto Reactions For News And RegulationsThe report compiled by the Federal Reserve Bank of Dallas initially questioned the efficiency of instituting actual regulations on cryptocurrencies. It argued that digital assets can “function without institutional backing and are intrinsically borderless.”Thus, regulations, more specifically national, could not provide the necessary effect. Yet, upon completion of the study, the report informed that “at the current juncture, authorities around the globe do have some scope to make regulation effective.”The

Topics:

Jordan Lyanchev considers the following as important: AA News, Regulations

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Cryptocurrency prices are quite susceptible to news, according to a recent paper. While, somewhat unsurprisingly, adverse announcements lead to immediate sharp declines, the establishment of clear regulations tends to mark serious market gains.

Crypto Reactions For News And Regulations

The report compiled by the Federal Reserve Bank of Dallas initially questioned the efficiency of instituting actual regulations on cryptocurrencies. It argued that digital assets can “function without institutional backing and are intrinsically borderless.”

Thus, regulations, more specifically national, could not provide the necessary effect. Yet, upon completion of the study, the report informed that “at the current juncture, authorities around the globe do have some scope to make regulation effective.”

The paper examined what the consequences in terms of price developments following particular newsworthy announcements on the matter are:

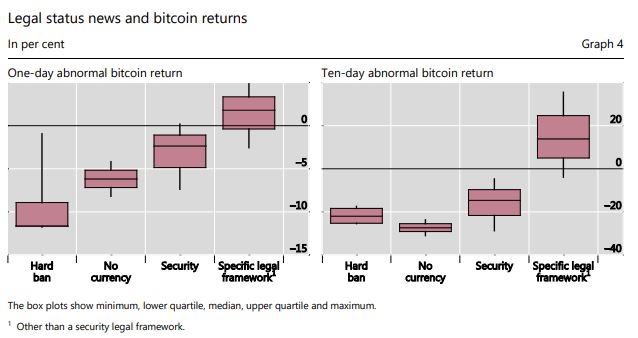

“News indicating possible novel legal frameworks tailored to cryptocurrencies and initial coin offerings (ICOs) coincide with strong market gains.”

The document specified that the introduction of a non-security legal framework generates even more favorable returns. “Most likely as those frameworks generally come with oversight rules that are milder than those under securities law,” the paper reasoned.

Bitcoin, used as an example, sees serious gains in a one-day and ten-day period, as the graph above illustrates after news of clear regulations.

Although the cryptocurrency market operates under “no formal legal homes” and is available for international trading, it still relies on “regulated institutions to convert regular currency into cryptocurrency.” The paper’s conclusion estimated this to be the primary reason behind the price developments in light of regulations.

Negative News Is Always Bad

The report, rather expectedly, is quite clear on the matter. The cryptocurrency market marks a rapid adverse reaction on anything even remotely negative.

“Besides general bans on [cryptocurrency] usage for financial transactions, news events related to their possible treatment under securities market law have strongly adverse impacts, as do events explicitly signaling that they will not be treated as a currency.

Regulatory news regarding anti-money laundering or combating the financing of terrorism (AML/CFT) measures and limits on the interoperability of cryptocurrencies with the regulated financial system adversely impacts cryptocurrency markets.” – the paper explained.

For instance, back in 2019, when the Chinese government clarified that digital assets are (still) illegal, Bitcoin’s price dropped to a 6-month low almost immediately.

However, the document also informed that unspecific general warnings and news regarding central bank digital currency issuance and regulation have no outlining effect.