Last week’s massive Bitcoin sell-off that drove its price to below ,000 came from short-term holders, new data shows. Long-term holders, on the other hand, are not moving or selling their BTC assets, at least for now.New Players Sold Their BTCMarch 12th-13th this year later became known as one of the worst trading days in the cryptocurrency market. Bitcoin, and most alternative coins, decreased by as much as 50% in less than 24 hours after extensive sell-offs.According to a report compiled by the popular monitoring resource, CoinMetrics, most BTC sales came from short-term holders. They came to this conclusion by monitoring on-chain transactions on substantial Bitcoin holdings on the days before the drop that were previously untouched for a specific period.Thus, the document indicates

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, HODL

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Last week’s massive Bitcoin sell-off that drove its price to below $4,000 came from short-term holders, new data shows. Long-term holders, on the other hand, are not moving or selling their BTC assets, at least for now.

New Players Sold Their BTC

March 12th-13th this year later became known as one of the worst trading days in the cryptocurrency market. Bitcoin, and most alternative coins, decreased by as much as 50% in less than 24 hours after extensive sell-offs.

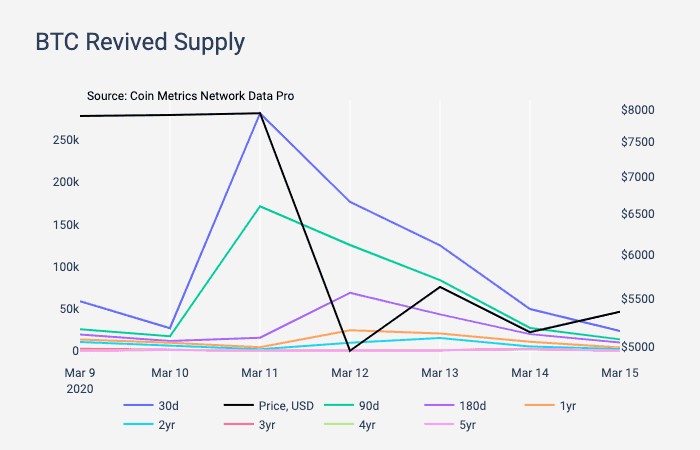

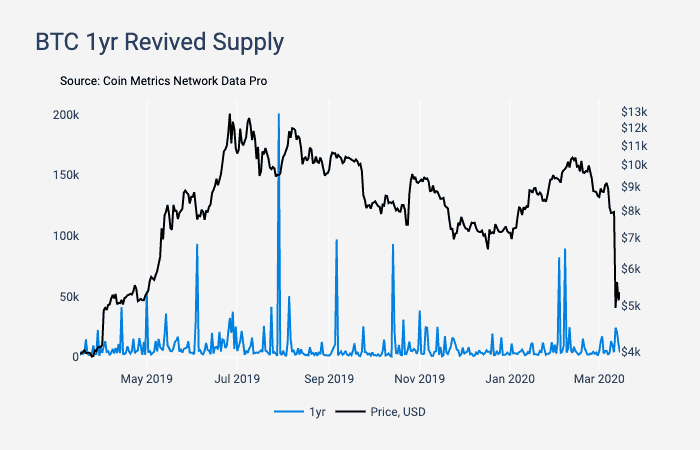

According to a report compiled by the popular monitoring resource, CoinMetrics, most BTC sales came from short-term holders. They came to this conclusion by monitoring on-chain transactions on substantial Bitcoin holdings on the days before the drop that were previously untouched for a specific period.

Thus, the document indicates that 281k BTC untouched for at least thirty days were revived, but only 4,131 of that amount was not moved for more than a year. In other words, almost 277k bitcoins were transferred on March 11th and March 12th from investors who have held the assets for less than a year.

At the same time, CoinMetrics informed that long-term holders (or HODLers) hadn’t moved an unusually large supply of their Bitcoin holdings.

Bitcoin SORP & MVRV Below One

The report also touched upon two compelling indicators regarding Bitcoin’s performance – SOPR and MVRV. The former provides the ratio of price sold (BTC’s price at the time new outputs are created) over the price paid (BTC’s price at the time a transaction’s inputs were created.)

Ultimately, it means that when the SOPR is below one, the investors are selling at a loss. In this case, the indicator dropped to 0.842 on March 12th – the lowest point it has recorded since February 2012.

The second one – MVRV – compares Bitcoin’s market capitalization to its realized capitalization. The latter is the estimated aggregate cost basis of the asset.

MVRV above one generally means that speculators have a higher average market valuation than holders and vice-versa if it’s below one. On March 12th, Bitcoin’s MVRV not only dropped below one, but it recorded its worst one-day drop of 0.5 points since December 2013. This, though, could be a good buying point, as the report concluded:

“In hindsight, the past periods where MVRV dropped below one have been the best times to accumulate BTC at a relatively discounted price.”

Other cryptocurrencies that went through a severe drop in their realized caps are Ethereum (-6%), Chainlink (-8.44%), and Tezos (-9.12%)

The Money Flow Goes To Stablecoins and Exchanges

The paper also brought up where most of the money flows went in this period of significant sell-offs. In the traditional financial markets, most investors are turning their assets into cash. In the cryptocurrency space, the situation is similar but instead of cash – its stablecoins.

In five days, from March 10th to 15th, Ethereum-issued Tether (USDT_ETH) market cap has risen by approximately $300M. USD Coin (USDC), another popular stablecoin, noted a market cap growth close to $150M during those dates.

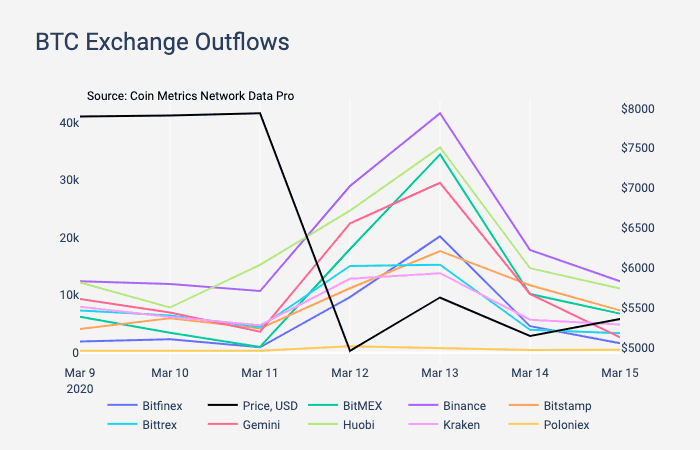

Additionally, the largest cryptocurrency exchanges, including Binance, Bitfinex, BitMEX, Bitstamp, Huobi, and others, had an in-flow of over 160k BTC on March 12th. Similarly, those exchanges saw a total outflow of about 171k BTC on the same date.

Both of these turned out to be the most substantial one-day inflows and outflows in over two years.

The leading Bitcoin margin trading exchange, BitMEX, noted the largest inflow. Contrary, Binance, and Huobi had more daily outflows.