So far, the past month had seen some of the worst days in Bitcoin’s price history. Following the emerging coronavirus crisis, Bitcoin plunged from a high of over K in mid-February, to a current low of ,600 reached March 12. Since then, the price had recovered to the ,000 area, but March is not yet over.The drop affected almost all of the cryptocurrencies and stablecoins were the only ones that saw their market cap increased.Stablecoins’ Growth Amid The Sell-OffsAs the name suggests, stablecoins find a valuable place among all cryptocurrencies because of their “stability”. In a market with generally high levels of volatility, traders can quickly exit their positions from a violently swinging coin and store their funds in a more stable digital asset, pegged to the USD in most cases.A

Topics:

Jordan Lyanchev considers the following as important: AA News, Stablecoins

This could be interesting, too:

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

So far, the past month had seen some of the worst days in Bitcoin’s price history. Following the emerging coronavirus crisis, Bitcoin plunged from a high of over $10K in mid-February, to a current low of $3,600 reached March 12. Since then, the price had recovered to the $6,000 area, but March is not yet over.

The drop affected almost all of the cryptocurrencies and stablecoins were the only ones that saw their market cap increased.

Stablecoins’ Growth Amid The Sell-Offs

As the name suggests, stablecoins find a valuable place among all cryptocurrencies because of their “stability”. In a market with generally high levels of volatility, traders can quickly exit their positions from a violently swinging coin and store their funds in a more stable digital asset, pegged to the USD in most cases.

A perfect example of their usage came last week when the market crashed over 50% in one single day. A recent report indicated that during the most significant stages of the sell-off, short term traders turned to stablecoins.

Therefore, even though the total market cap saw its value slashed in half from over $300m a month ago, most stablecoin are on the rise in that manner.

According to data from CoinGecko, USDC, the stable coin backed by Circle, had seen an increase of 55% in its market cap. Until February 27, all USDC was equivalent to $430 million. As of writing these lines, the market cap grew to almost $670 million. Paxos Standard (PAX) saw a minor increase of 9% to a current market cap of $230 million.

The biggest gainer has been BUSD (Binance USD), with an increase of over 100%. It seems rather logical since the coin is available on the leading cryptocurrency exchange by trading volume – Binance.

Despite the above, True USD, Paxos and Gemini Dollar didn’t notice a significant change in their market cap, and MakerDAO saw a decrease of 30% in its market cap due to the recent instability of the promising project.

Still Far From Tether (USDT)

Despite the new additions in the stablecoin market, Tether (USDT) is still well in the lead in this race. It’s the most widely used, and naturally, it has the largest market capitalization of over $4.5 billion. After the latest price crash, Tether is now the 4th biggest cryptocurrency by market cap.

As the majority generally prefer using it, USDT ERC-20 transactions noted an all-time high last year. Ultimately, they utilized almost 25% of the whole Ethereum network.

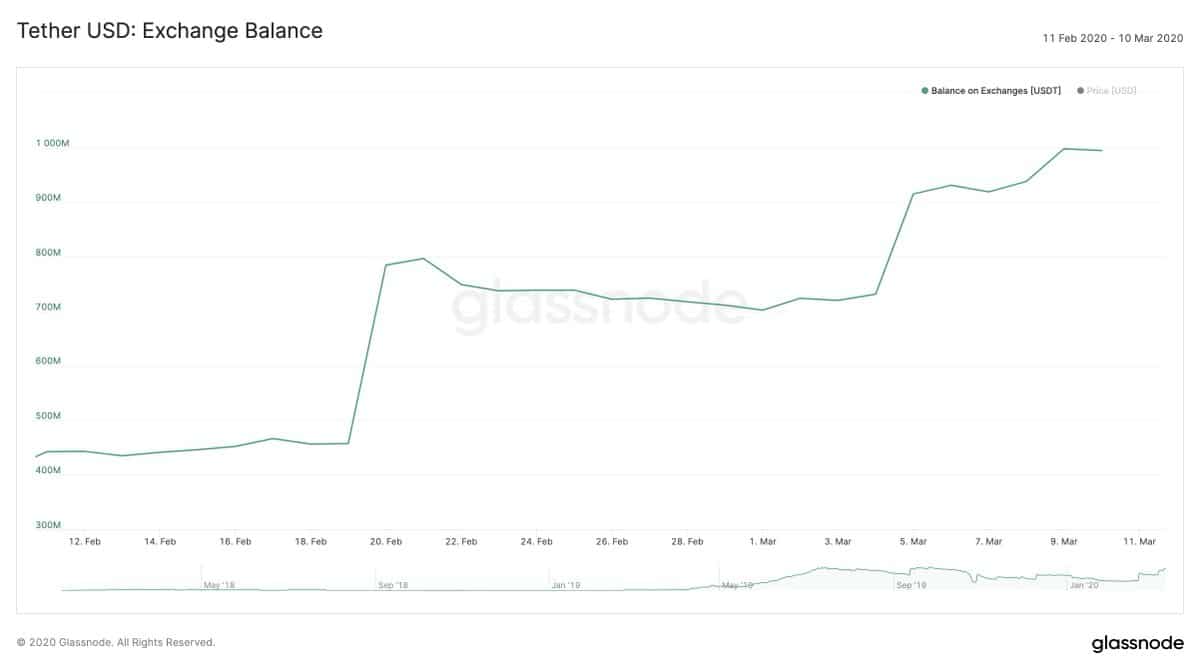

More recently, USDT ERC-20 balance on cryptocurrency exchanges has more than doubled in the past month, and it’s close to $1 billion.

However, the emergence of new stablecoins may soon threaten Tether’s dominance over the market. According to a recent report, USDC, PAX, TUSD, and DAI had surpassed USDT in terms of transfer counts at the start of the year.