Ethereum investors have been accumulating and holding substantial amounts lately. More than 77% of ETH in externally owned accounts (EOAs) has not moved in the past six months, new data revealed.Ethereum Investors Hodl And AccumulateThe price of Ethereum, similarly to most cryptocurrencies, went through violent turbulence lately. Starting 2020 at about 1, reaching a yearly high of 0, and then succumbing to the mid-March sell-offs caused by the COVID-19 pandemic and bottoming at .Lately, however, the second-seeded coin by market cap has surged and is currently trading at 2, representing an increase of 62% in 2020 alone.Despite these excessive levels of fluctuations, new information provided by the popular digital asset analysis company, Glassnode Insights, indicated that the

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin-Halving, btcusd, btcusdt, ETHBTC, Ethereum (ETH) Price, ethereum 2.0, ethusd, HODL

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Ethereum investors have been accumulating and holding substantial amounts lately. More than 77% of ETH in externally owned accounts (EOAs) has not moved in the past six months, new data revealed.

Ethereum Investors Hodl And Accumulate

The price of Ethereum, similarly to most cryptocurrencies, went through violent turbulence lately. Starting 2020 at about $131, reaching a yearly high of $290, and then succumbing to the mid-March sell-offs caused by the COVID-19 pandemic and bottoming at $87.

Lately, however, the second-seeded coin by market cap has surged and is currently trading at $212, representing an increase of 62% in 2020 alone.

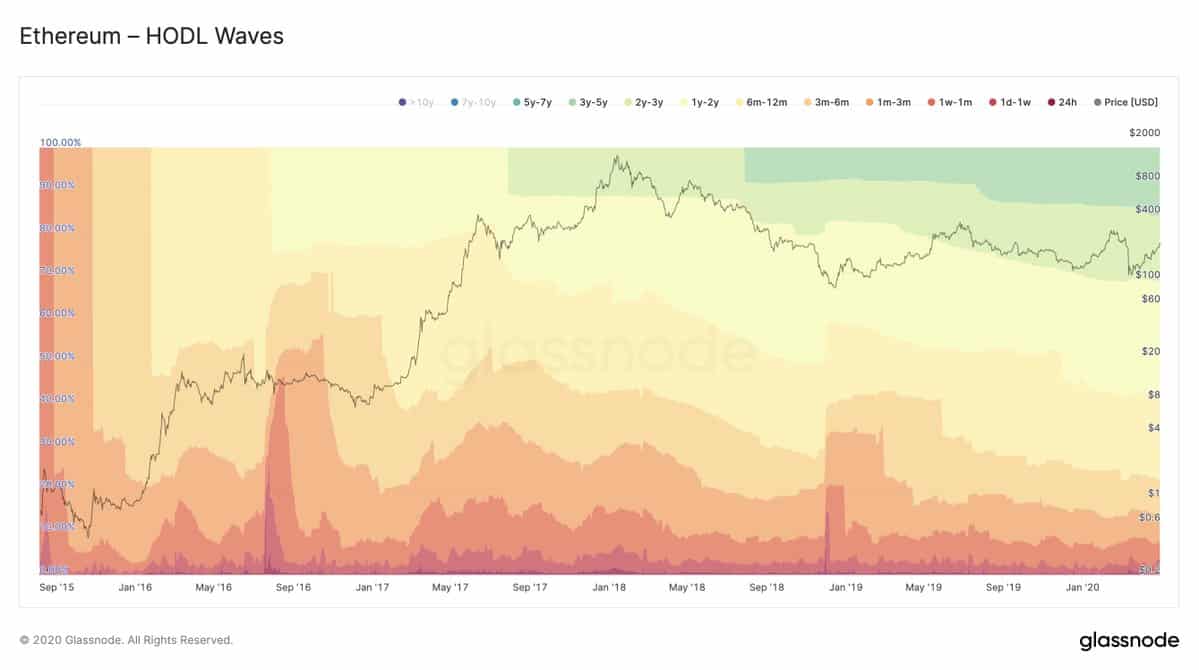

Despite these excessive levels of fluctuations, new information provided by the popular digital asset analysis company, Glassnode Insights, indicated that the majority of Ethereum investors prefer holding their positions.

77.7% of the supply in the so-called externally owned accounts has not moved in six months. 57.6% has not seen a relocation in the past year, and 31.6% in two years. It’s worth noting, though, that the data excludes any portions locked in smart contracts.

At the same time, the largest 100 Ethereum wallet addresses had started accumulating higher percentages of the token’s total supply again.

The upcoming release of the long-awaited Ethereum 2.0 could be the primary reason behind those numbers. The new version, which will complete the migration from the current Proof-of-Work consensus algorithm to Proof-of-Stake, raises interest in other entities as well.

Grayscale, the leading digital asset management company, for example, has bought almost half of all mined ETHs in 2020 to cope with the increased demand from institutional investors.

Bitcoin Hodlers Are Not Behind

The primary cryptocurrency notes similar statistics. For instance, Bitcoin hodlers have been particularly active in accumulation in the past several weeks, per a recent report. It only solidified information from a previous one, which informed that the number of Bitcoin addresses containing at least 1,000 BTC was at a 2-year high.

Additionally, daily on-chain transactions recently reached a 15-months low, hinting that BTC holders also prefer keeping their positions.

And, similarly to Ethereum again, the largest cryptocurrency by market cap has a highly significant event coming up. While the exact date of the Ehereum 2.0 release is unclear at the moment, the Bitcoin Halving is scheduled to take place in less than two weeks.

It’s an event that will slash in half the block rewards for Bitcoin miners to 6.25 BTC. Historically, the price of the asset has surged following the two previous Halvings, which causes lots of speculation within the community that another increase is to follow.

However, history should not be employed as a valid price indicator for future events. Besides, the disruptions prompted by the COVID-19 outbreak also imply that the aftermath of the third-ever Bitcoin Halving may be somewhat different.