XRP surged by a strong 5% today as it reaches the %excerpt%.19 level.The cryptocurrency rebounded at the rising trend line this weekend, which allowed it to surge back into the %excerpt%.191 resistance today.Against Bitcoin, XRP is trading sideways between 2600 SAT and 2700 SAT.Key Support & Resistance LevelsXRP/USD:Support: %excerpt%.182, %excerpt%.171, %excerpt%.16.Resistance: %excerpt%.191, %excerpt%.2, %excerpt%.215.XRP/BTC:Support: 2600 SAT, 2560 SAT, 2525 SAT.Resistance: 2710 SAT, 2750 SAT, 2800 SAT.XRP/USD: Ripple To Break Bearish .618 Fib Retracement ResistanceXRP was trading along the rising support trend line this weekend. It rebounded from here today as it surged into the resistance at %excerpt%.191, which is provided by a bearish .618 Fib Retracement level.Once XRP clears this resistance, it should be clear to head much higher and approach

Topics:

Yaz Sheikh considers the following as important: Ripple (XRP) Price, XRP Analysis

This could be interesting, too:

Jordan Lyanchev writes Ripple’s (XRP) Surge to Triggers Over Million in Short Liquidations

Jordan Lyanchev writes Trump Confirms Work on Strategic Crypto Reserve: XRP, ADA, SOL Included

Mandy Williams writes Ripple Releases Institutional DeFi Roadmap for XRP Ledger in 2025

Jordan Lyanchev writes ChatGPT and DeepSeek Analyze Ripple’s (XRP) Price Potential for 2025

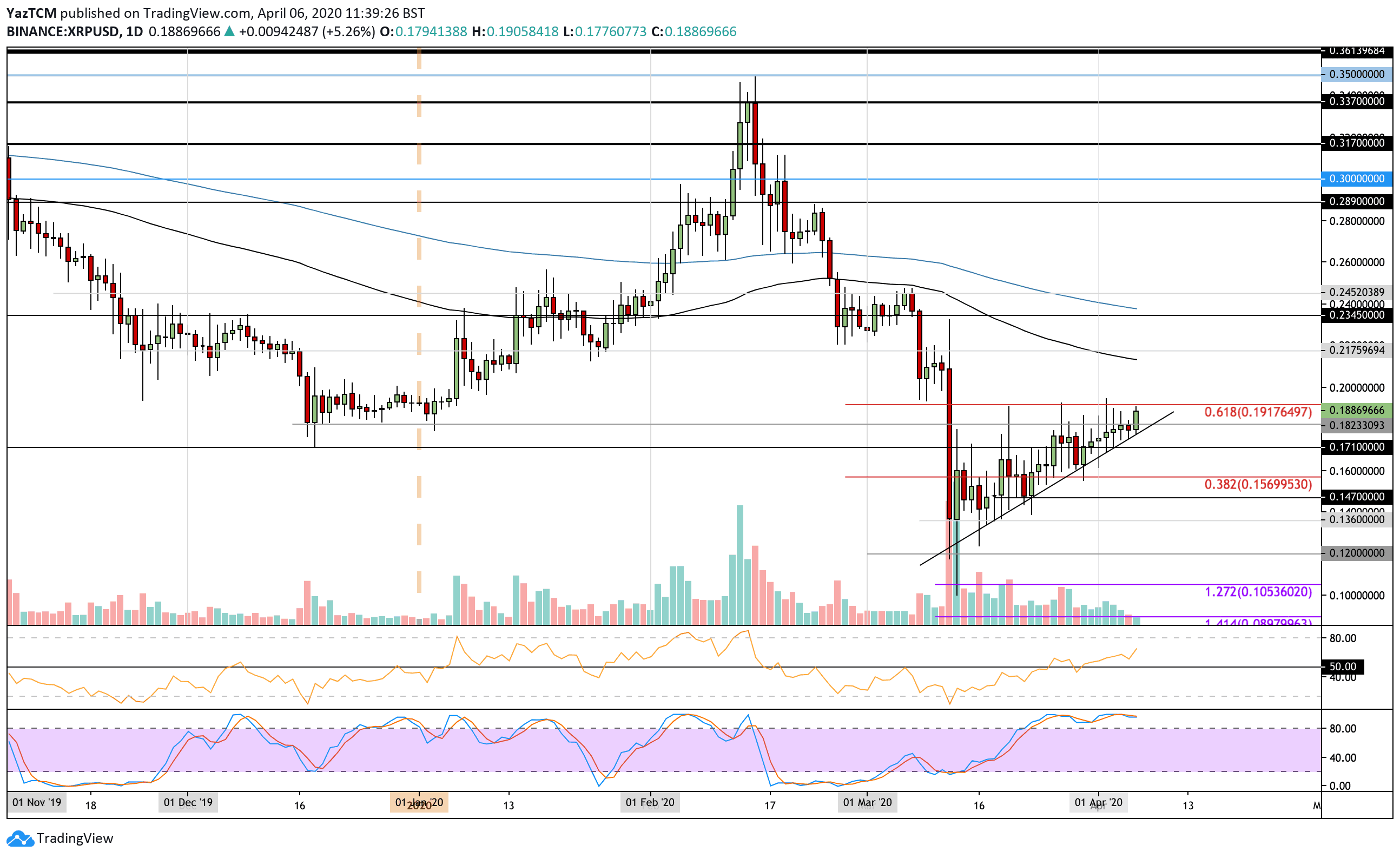

- XRP surged by a strong 5% today as it reaches the $0.19 level.

- The cryptocurrency rebounded at the rising trend line this weekend, which allowed it to surge back into the $0.191 resistance today.

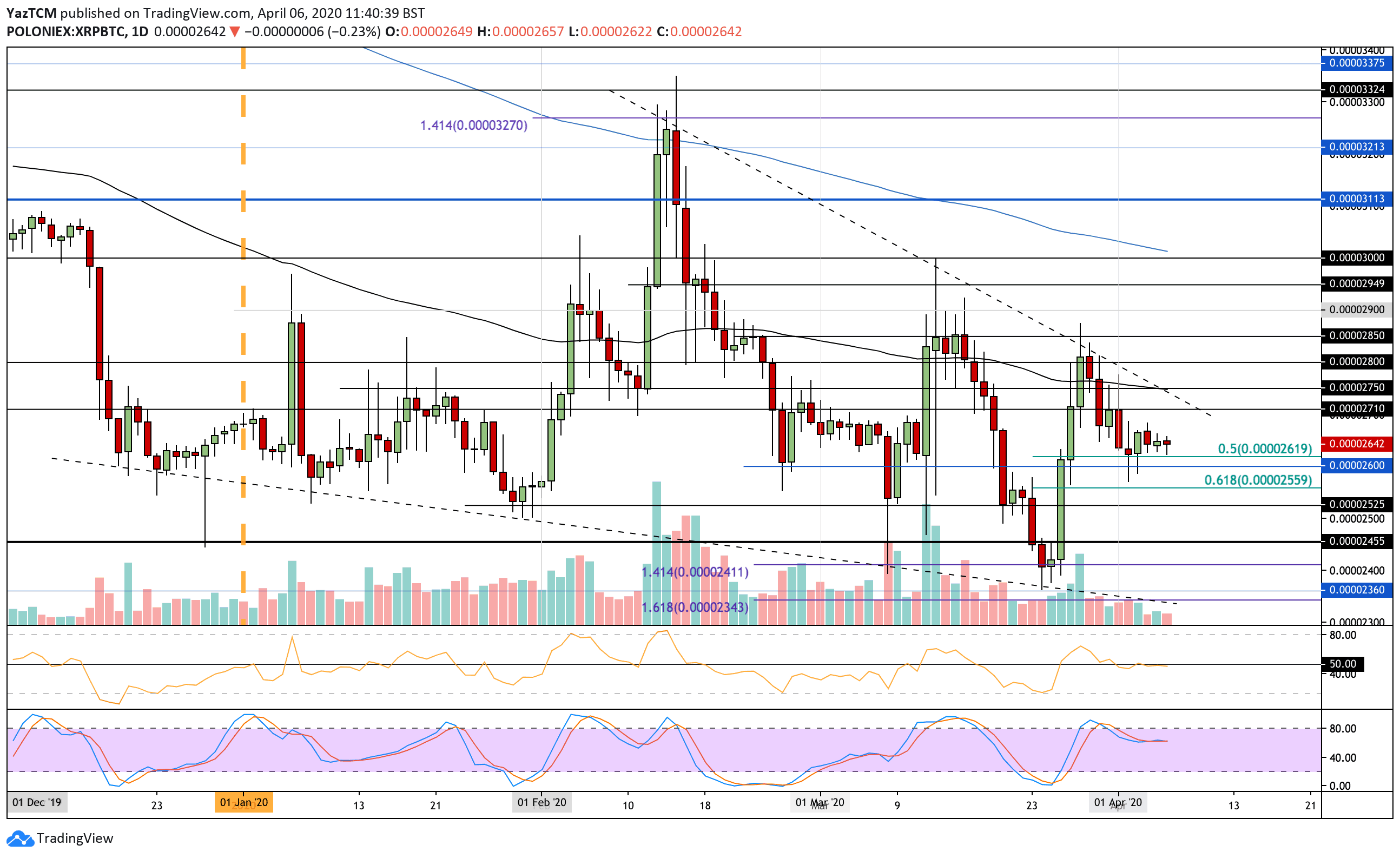

- Against Bitcoin, XRP is trading sideways between 2600 SAT and 2700 SAT.

Key Support & Resistance Levels

XRP/USD:

Support: $0.182, $0.171, $0.16.

Resistance: $0.191, $0.2, $0.215.

XRP/BTC:

Support: 2600 SAT, 2560 SAT, 2525 SAT.

Resistance: 2710 SAT, 2750 SAT, 2800 SAT.

XRP/USD: Ripple To Break Bearish .618 Fib Retracement Resistance

XRP was trading along the rising support trend line this weekend. It rebounded from here today as it surged into the resistance at $0.191, which is provided by a bearish .618 Fib Retracement level.

Once XRP clears this resistance, it should be clear to head much higher and approach $0.24 (March 2020 highs).

XRP-USD Short Term Price Prediction

Once the resistance at $0.191 is breached, higher resistance lies at $0.20, $0.215 (100-days EMA), and $0.23. Beyond this, additional resistance lies at $0.25 (200-days EMA) and $0.245.

Toward the downside, support lies at $0.182 and the rising trend line. Beneath the trend line, added support is located at $0.171, $0.16, and $0.147.

The RSI climbed well above the 50 level as the buyers start to take control of the market momentum. However, the Stochastic RSI is primed for a bearish crossover signal that could send the market lower.

XRP/BTC: Ripple Trading Sideways In April Against Bitcoin

Against Bitcoin, XRP has traded sideways between 2600 SAT and 2700 SAT during April 2020 as the RSI trades directly along the 50 level to indicate indecision within the market.

It is currently trading at support provided by a .5 Fib Retracement, but if it closes beneath here, XRP could be headed back beneath 2600 SAT.

XRP-BTC Short Term Price Prediction

From below, the first level of support lies at 2600 SAT. Beneath this, support lies at 2559 SAT (.618 Fib Retracement), 2525 SAT, and 2455 SAT.

On the other side, the first level of resistance lies at 2710 SAT. Above this, resistance lies at 2750 SAT, the falling trend line, 2800 SAT, and 2850 SAT.

The RSI needs to break above the 50 level for XRP to head toward the 2800 SAT level.