Bitcoin (BTC) and the general cryptocurrency markets are yet to fully recover from the massive sell-off on March 12, which left traders and hodlers scratching their heads as they watch the entire gains so far in 2020 being wiped off the board. Data gathered at that time suggested that the majority of sellers who rushed to sell their coins due to panic did so at a loss. The report further revealed that hodlers who had kept their BTC holdings in personal wallets started un-hodling by moving their assets to popular exchange for trades.During that period, there was a significant spike in the number of transactions as daily transfers within the network went as high as 368,000. BTC Transfer Hits 15-Months LowWith almost three weeks gone since the sell-off, daily on-chain transactions on the

Topics:

Mandy Williams considers the following as important: AA News, Bitcoin-Halving

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin (BTC) and the general cryptocurrency markets are yet to fully recover from the massive sell-off on March 12, which left traders and hodlers scratching their heads as they watch the entire gains so far in 2020 being wiped off the board.

Data gathered at that time suggested that the majority of sellers who rushed to sell their coins due to panic did so at a loss. The report further revealed that hodlers who had kept their BTC holdings in personal wallets started un-hodling by moving their assets to popular exchange for trades.

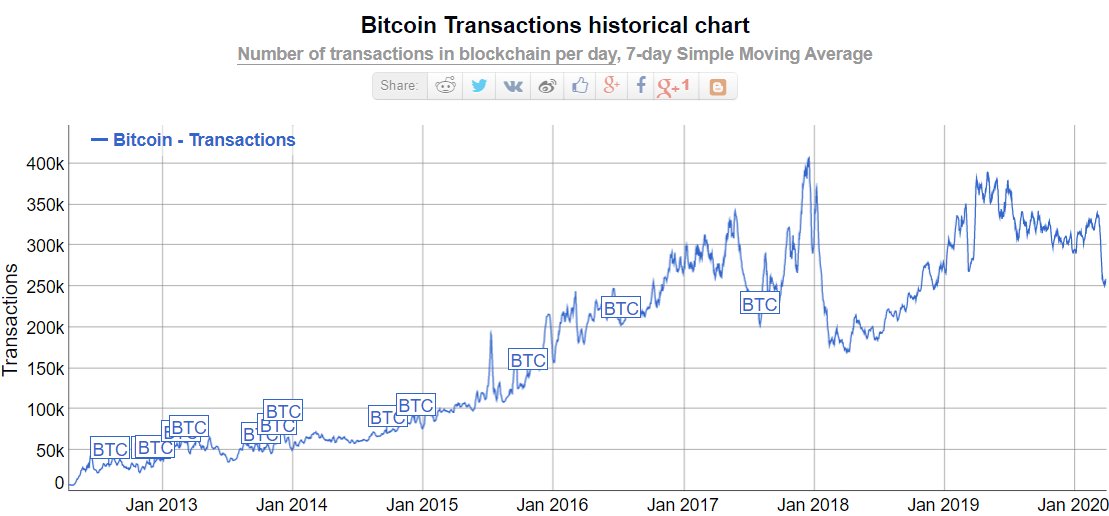

During that period, there was a significant spike in the number of transactions as daily transfers within the network went as high as 368,000.

BTC Transfer Hits 15-Months Low

With almost three weeks gone since the sell-off, daily on-chain transactions on the Bitcoin Network have declined to lows not seen since late 2018, according to data on Bitinfocharts.

The trend started recently, and it shows that Bitcoin transfers have dipped to its lowest level since December 2018, which is a 15-months low. Daily on-chain transactions are currently less than 250,000. This, perhaps, is an indication that hodlers are now comfortable as the market recovers.

Bitcoin Hash Rate Declines

The crash on March 12 did not only affect Bitcoin price, but it also affected miners’ confidence, forcing them to switch off their equipment to protect themselves against further loss.

Since late 2019 to the first week of March 2020, the hash rate was increasing continuously, but that no longer seems to be the case.

As of March 2, the hash rate on the Bitcoin network raced to a new high of 136 EH/s. However, it declined to as low as 95 TH/s following the drastic fall in the price of the cryptocurrency. Nonetheless, it’s currently recovering just like the price, and at the time of writing, it’s standing at 100 TH/s.

Meanwhile, as miners are preparing for the Halving, the event might be delayed because the average daily block time increased to 14 minutes since some miners temporarily halted their mining operations. Of course, that would largely depend on the overall state of the network in the couple of months ahead.