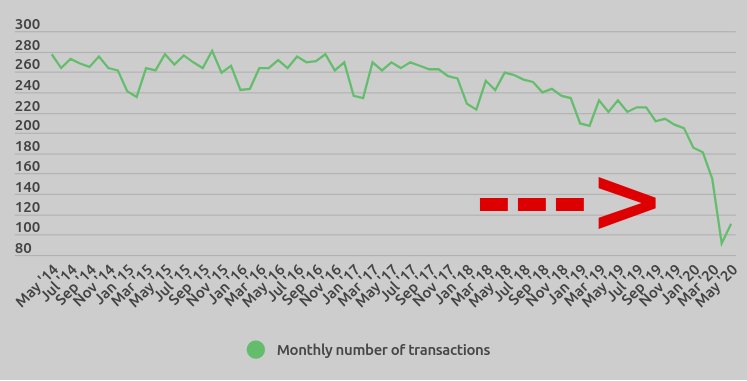

UK: Monthly Number of ATM Transactions in the UK Plunged by 40% Year-on-year Reaching 110.4 Million in May Data gathered by Buyshares.co.uk shows that the number of transactions at UK cash machines dropped by 29.87% between June 2019 and March 2020. The decline in transactions began in September last year to hit new lows. UK increasingly showing less interest in physical cash In June last year, the number of transactions was 220.66 million, while in March this year, the figure was 154.93 million. A notable decline began in September last year when 211.01 million transactions were recorded. At the end of January 2020, a sharp plunge was recorded with 185.07 million transactions. Between January and March 2020, the transactions declined

Topics:

Bitcoin Schweiz News considers the following as important: Allgemein, ATM, Cash, London, uk

This could be interesting, too:

Bitcoin Schweiz News writes Die Ferengi Rules of Acquisition: Das Geschäftsmanifest des Star-Trek-Universums

Fintechnews Switzerland writes 9fin Acquires Bond Radar to Expand Debt Market Intelligence

Bitcoin Schweiz News writes Das ist die Digital Euro Association: Die Zukunft des digitalen Geldes

Bitcoin Schweiz News writes Schockierende Steuer-Idee: Britische Bankerin will Bitcoin-Besitzer zur Kasse bitten, um Aktien zu retten!

UK: Monthly Number of ATM Transactions in the UK Plunged by 40% Year-on-year Reaching 110.4 Million in May

Data gathered by Buyshares.co.uk shows that the number of transactions at UK cash machines dropped by 29.87% between June 2019 and March 2020. The decline in transactions began in September last year to hit new lows.

UK increasingly showing less interest in physical cash

In June last year, the number of transactions was 220.66 million, while in March this year, the figure was 154.93 million. A notable decline began in September last year when 211.01 million transactions were recorded. At the end of January 2020, a sharp plunge was recorded with 185.07 million transactions. Between January and March 2020, the transactions declined by 16.28%.

On the other hand, the monthly value of cash withdrawals from LINK ATMs networks within the UK took a deep dive between December last year and March this year. During this period, the value declined by 25.38%. In December 2019, the value was £9.98 billion before later dropping to £8.18 billion a month later.

By February this year, the value was £8.25 billion before plunging again to £7.45 billion in March. Between January 2014 and March 2020, the highest value was in December 2016 at £12.04 billion before dropping by 21.67% to £9.43 billion in January 2017.

The Buyshares.co.uk research report notes that the coronavirus alongside other factors contributed to the overviewed transactions and value of cash withdrawals. According to the report:

“Besides the pandemic, other factors like high fees and increasing preference for cashless transactions were contributing to the plunge.”

The research also overviewed the number of cash machines across the UK. According to the data, the number of ATMs has been declining since the fourth quarter of 2017 when the figure was 69,603 a drop of 13.77% compared to figures recorded in the first quarter of 2020 at 60,012. Between the first quarter of 2014 and the first quarter of this year, the number of ATMs has declined by 11.92%.

From the data, the number of ATMs in the UK was on a steady increase from 2014 to hit a high of 70,682 in the second quarter of 2016. Between the third quarter of 2016 and the third quarter of 2017, the number of ATMs remained fairly constant with an average of 70,095 machines.