An MEV bot conducted 14 transactions in a single block to launch a sandwich attack on an unsuspecting user to only net in profits. A Maximum Extractable Value (MEV) bot found an opportune moment to execute a million flash loan to conduct a sandwich attack on an unsuspecting user. However, the ordeal only netted it a meager in profits after gas fees through the flash loan exploit. The incident offered comic relief to many in the crypto community during a period when high-profile hacks and attacks are occurring frequently. Arkham Intelligence brought the successful yet failed attack to light. “An MEV Bot just took out a Million flashloan to make less than in profit,” Arkham mentioned in an X post. “It sandwiched a user trying to swap K of SHFL to WETH using around 2%

Topics:

Suraj Manohar considers the following as important: defi, Hacked, News

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

An MEV bot conducted 14 transactions in a single block to launch a sandwich attack on an unsuspecting user to only net $20 in profits.

A Maximum Extractable Value (MEV) bot found an opportune moment to execute a $12 million flash loan to conduct a sandwich attack on an unsuspecting user. However, the ordeal only netted it a meager $20 in profits after gas fees through the flash loan exploit.

The incident offered comic relief to many in the crypto community during a period when high-profile hacks and attacks are occurring frequently. Arkham Intelligence brought the successful yet failed attack to light. “An MEV Bot just took out a $12 Million flashloan to make less than $20 in profit,” Arkham mentioned in an X post. “It sandwiched a user trying to swap $5K of SHFL to WETH using around 2% slippage. Unlucky.”

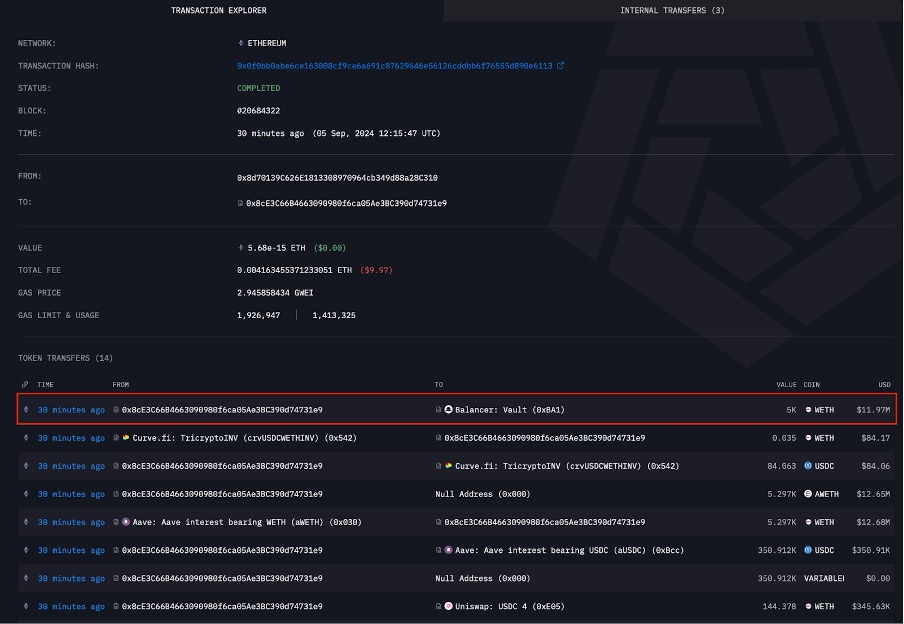

Source: Arkham Intelligence

As per Arkham, the flash loan occurred over 14 transactions, with everything bundled into the same block. These transactions involved the bot taking out loans of $11.97 million in wrapped Ether (wETH) to launch a sandwich attack on a user swapping about $5,000 of Shuffle (SHFL) tokens. Etherscan details show the bot leveraging DeFi protocols like Aave and Uniswap for these transactions and conducting them within 12 seconds.

Sandwich Attacks Can Net Millions

While this attempt led to minimal profits, MEV bots have conducted sandwich attacks to bring in millions and continue to do so. Essentially, these attacks target users conducting trades on DeFi protocols and initiate numerous transactions. These transactions often have varying gas amounts, some more than what the user is paying and others less. Resultingly, the user’s transaction gets sandwiched between these transactions as block validators pick the transactions from the mempool. In the process, the value of the assets they are trading for drops compared to market value, allowing the attacker to profit from the ordeal.