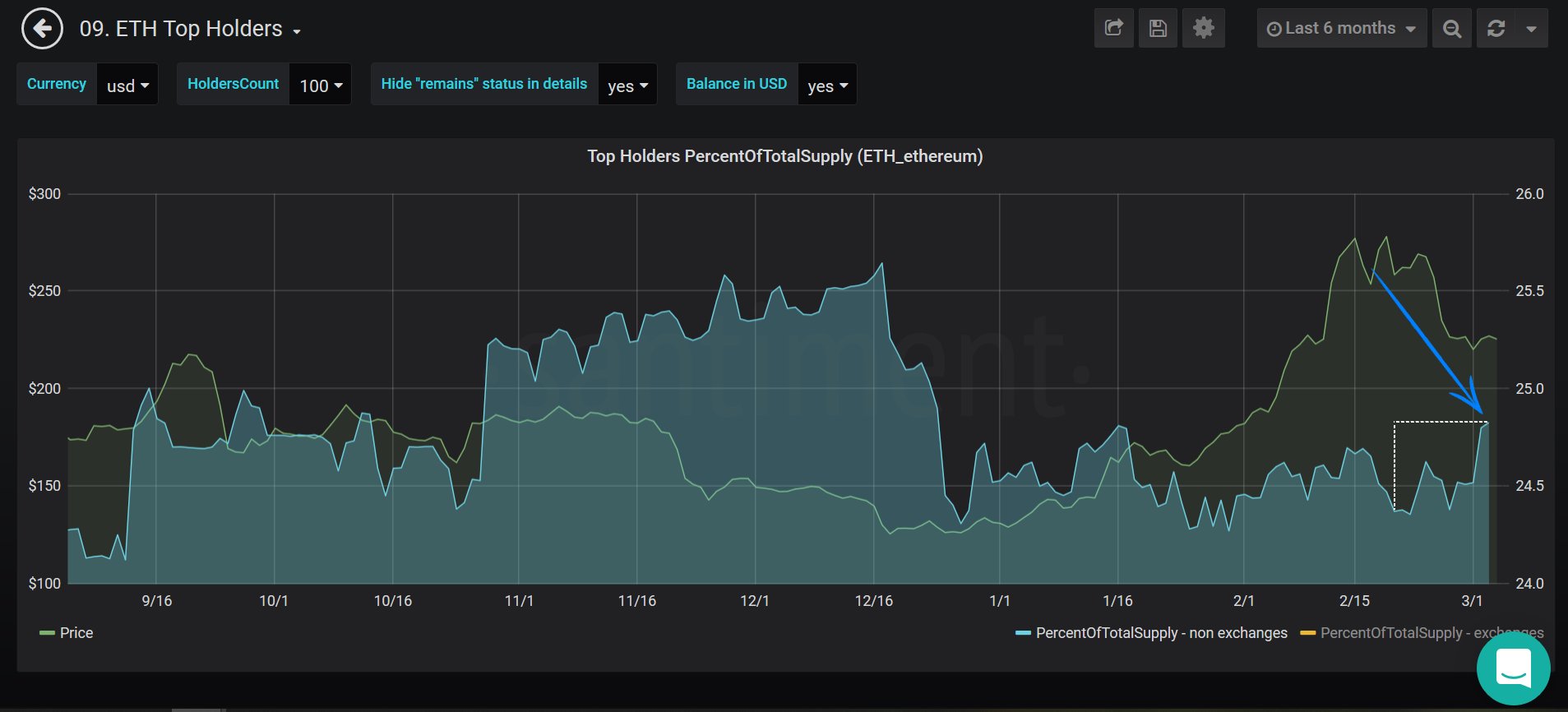

With Ethereum (ETH) price consolidating over the last couple of weeks, top holders of the second largest cryptocurrency have been filling their bags with more coins, according to new data from Santiment, an on-chain metrics provider.According to the report, the largest 100 Ether wallet addresses have started accumulating higher percentages of the token’s total supply again, despite the market conditions. These accumulations are an indication that the top holders of the coin (in this case, ETH) are having a “collective sentiment,” and might indicate that the token is undervalued at its current price. ETH Accumulation? data by Santiment10 Exchanges Hold Almost 17% of Total ETH SupplyFurther data from TokenAnalyst suggests that ten major crypto exchanges are currently holding 16.8% of ETH’s

Topics:

Mandy Williams considers the following as important: AA News, Ethereum (ETH) Price, ethereum 2.0

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

With Ethereum (ETH) price consolidating over the last couple of weeks, top holders of the second largest cryptocurrency have been filling their bags with more coins, according to new data from Santiment, an on-chain metrics provider.

According to the report, the largest 100 Ether wallet addresses have started accumulating higher percentages of the token’s total supply again, despite the market conditions.

These accumulations are an indication that the top holders of the coin (in this case, ETH) are having a “collective sentiment,” and might indicate that the token is undervalued at its current price.

10 Exchanges Hold Almost 17% of Total ETH Supply

Further data from TokenAnalyst suggests that ten major crypto exchanges are currently holding 16.8% of ETH’s total supply in their balances, which amounts to 18.5 million ETH (~$4.2 billion).

The exchanges include Huobi, Binance, Bitfinex, Poloniex, Okex, Gemini, Kucoin, Bitstamp, Kraken, and Bittrex. Huobi, however, dominates by holding a massive 4.75M ETH in its balance, followed by Binance, Bitfinex, and Kraken with balances of 2.78M ETH, 2.58M ETH, and 2.5M ETH respectively.

Ethereum 2.0: Coming Up Next

The Ethereum community is expecting the implementation of Ethereum 2.0 to address some critical issues like speed, scalability, and security on the network.

Although it is uncertain if the updates will have a positive effect on the price of the cryptocurrency, the coin’s value grew by almost 50% after the testnet went live last year.

Regarding the current price level, ETH is not left behind as the rest of the crypto market gathers momentum for a recent positive trend. At the time of writing, the coin is on the green side of the market, trading safely above $230, which represents a 3% daily price gain.

According to the recent ETH price analysis, ETH had bounced nicely from the $220 support level. However, a short-term bullish trend cannot be confirmed until the Ethereum breaks above $240.