Last Thursday, Bitcoin broke out a triangle pattern, the second in the same week, as can be seen on the following 4-hour chart. The breakout initiated an immediate 0 price gain, surpassing the 00 benchmark level.Over the past two days, after breaking above the K mark, we saw Bitcoin trading in a tight range between 00 and 00.While Wall Street and the global markets were crashing further 5% over the past two days of trading, Bitcoin successfully disconnected its recent correlation to the markets, and now all eyes are on the primary cryptocurrency – is Bitcoin a real safe-haven like Gold or not?Back to the charts: the recent declining amount of trading volume, along with the consolidation of the RSI indicator around 50, likely to predict a huge move coming up.It’s still early

Topics:

Yuval Gov considers the following as important: BTC Analysis

This could be interesting, too:

CryptoVizArt writes Bitcoin Price Analysis: Has BTC Found Strong Support After the Recent Sell-Off?

CryptoVizArt writes Bitcoin Price Analysis: Is BTC In Danger of Falling to ,000 Soon?

CryptoVizArt writes Bitcoin Price Analysis: After Hitting 0K, What’s Next for BTC?

CryptoVizArt writes Bitcoin Price Analysis: Is BTC Headed Back Toward 0K Following Today’s Recovery?

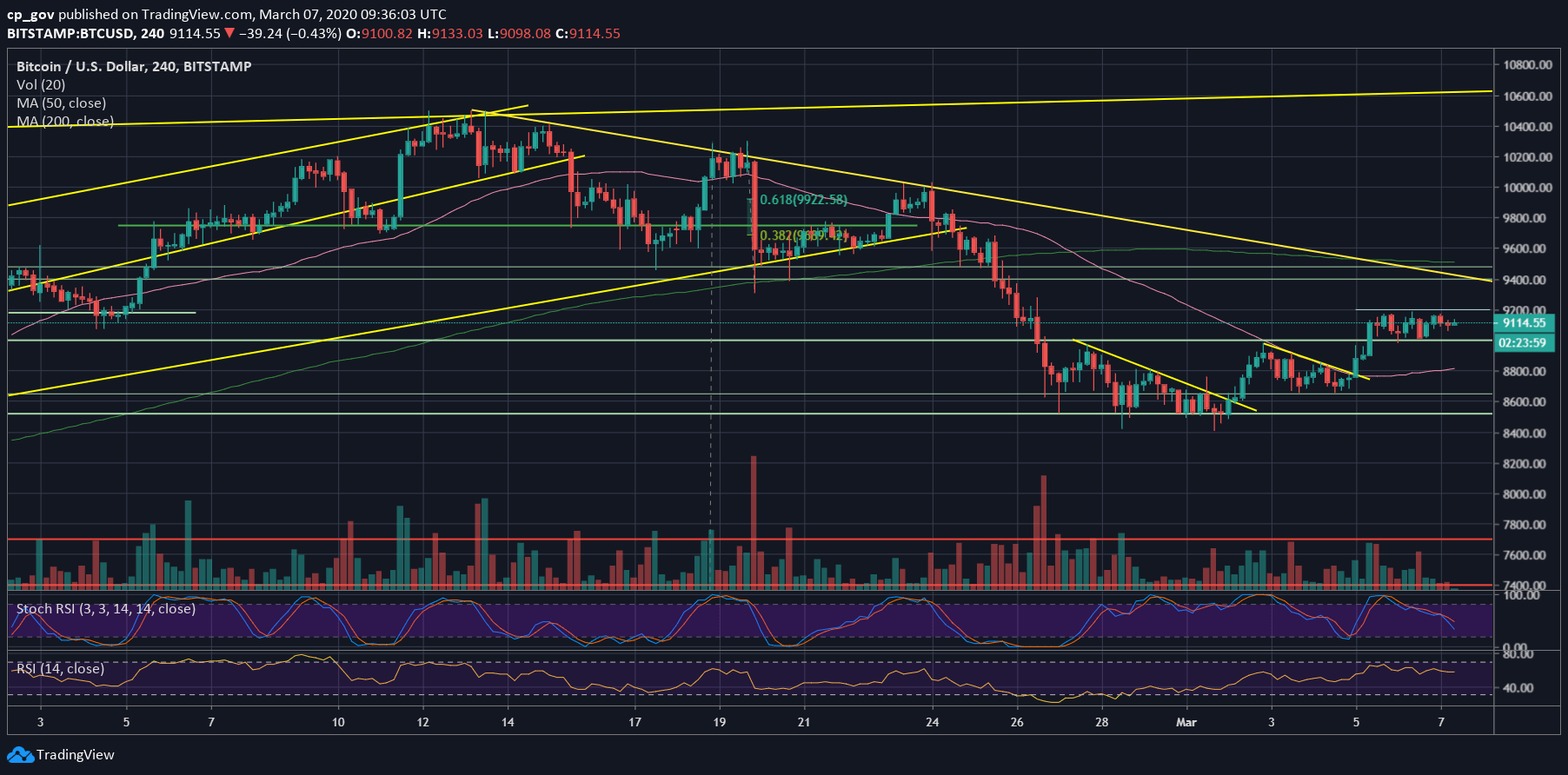

Last Thursday, Bitcoin broke out a triangle pattern, the second in the same week, as can be seen on the following 4-hour chart. The breakout initiated an immediate $400 price gain, surpassing the $9000 benchmark level.

Over the past two days, after breaking above the $9K mark, we saw Bitcoin trading in a tight range between $9000 and $9200.

While Wall Street and the global markets were crashing further 5% over the past two days of trading, Bitcoin successfully disconnected its recent correlation to the markets, and now all eyes are on the primary cryptocurrency – is Bitcoin a real safe-haven like Gold or not?

Back to the charts: the recent declining amount of trading volume, along with the consolidation of the RSI indicator around 50, likely to predict a huge move coming up.

It’s still early to say whether the coming-up move will be to the bullish or bearish direction; however, a break above $9200 or below $9000 is likely to decide the short term for Bitcoin price.

Total Market Cap: $263.7 billion

Bitcoin Market Cap: $166.7 billion

BTC Dominance Index: 63.2%

*Data by CoinGecko

Key Levels To Watch & Next Possible Targets

– Support/Resistance levels: As mentioned above, Bitcoin is trading between $9000 and $9200.

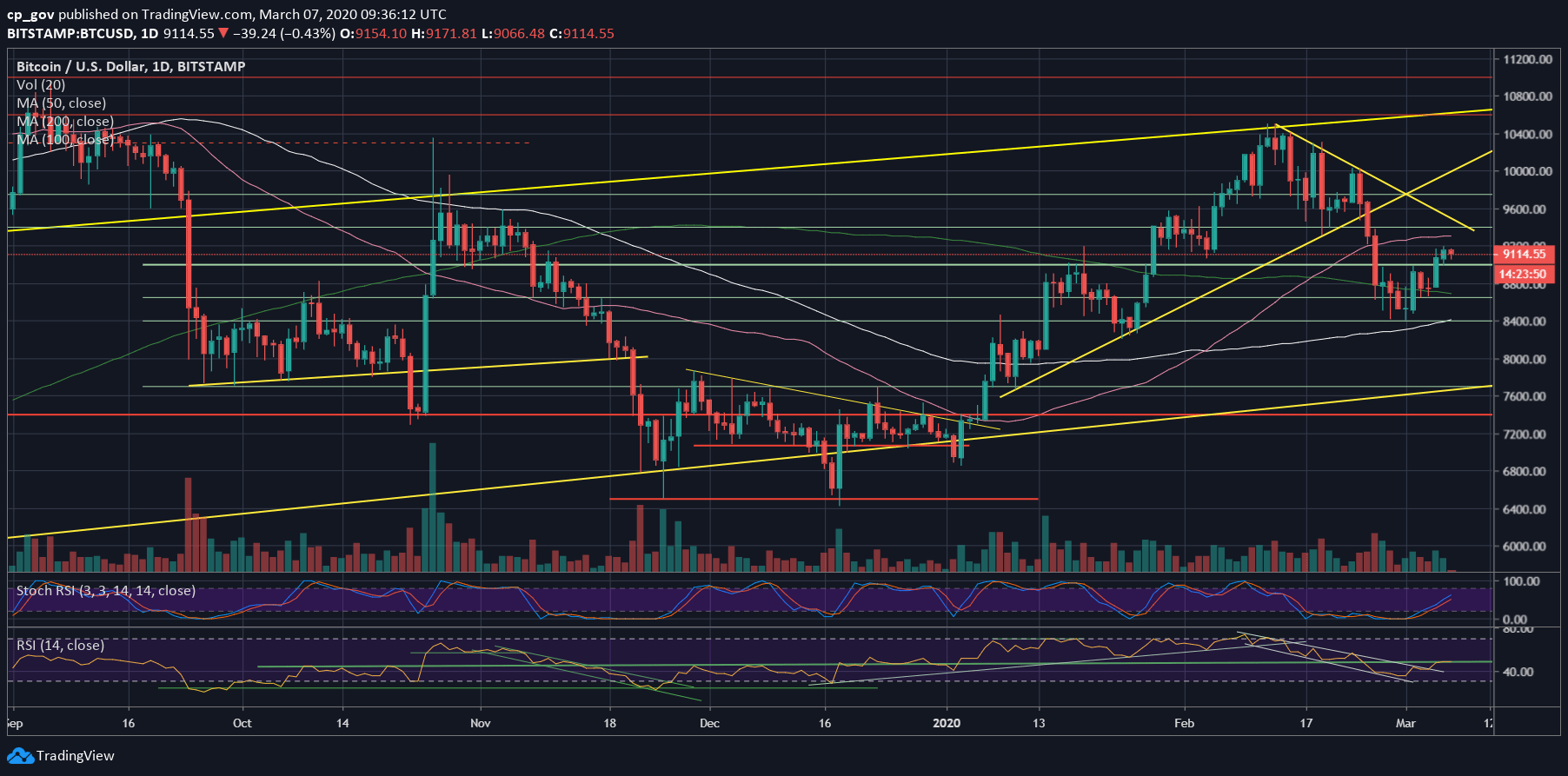

From above, the first level of resistance is $9200. Further above is $9300, which is also the 50-days moving average line (marked pink, ~$9310), along with a mid-term descending trend-line marked on the daily chart. In case the last two are broken up, then the next resistance is $9400 and $9600.

From below, the first level of support is the $9000 mark. Further below lies $8800 and $8700, which is also where lies the 200-days moving average line (marked light green on the following daily chart). The next support lies at $8650 (the low from the past week), before the $8500 support level.

– The RSI Indicator: As mentioned above, the momentum indicator is stuck at the 50 crucial level. This is a turning point between a bearish and bullish momentum.

– Trading volume: As discussed above, the trading volume is declining, indicating a possible coming up move.