Bitcoin futures on the Chicago Mercantile Exchange (CME) have recorded the largest price gap to date of about $3,000. This came after a three-day Christmas break for BTC trading on the regulated exchange and a massive price jump for the asset resulting in consecutive all-time highs.Biggest BTC Gap On CMELaunched in late 2017, CME’s BTC futures product enables institutional investors to trade the primary cryptocurrency on a regulated platform. However, being a regulated establishment also...

Read More »Bitcoin Open Interest and Futures Volume on Binance at ATH As BTC Price Eyes $20,000

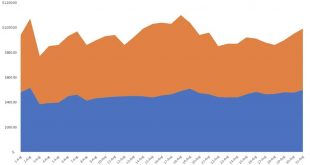

Bitcoin price just surged past the $19,000 mark and is looking to retake the previous all-time high of $20,000. This spike in volatility has caused all BTC markets to experience some serious trading traffic – especially the bitcoin futures market. And how? Well, open interest in the Binance futures market just topped $1.2 billion.Binance Bitcoin Futures Market Register Record Open Interest And Daily VolumesAccording to the crypto market and on-chain analysis firm Glassnode, the bitcoin...

Read More »Binance Bitcoin Futures Markets Clock Highest 24h Volumes as Institutions Go Long

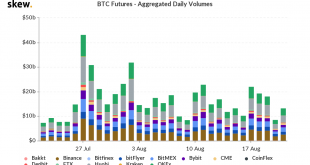

With bitcoin’s latest rally beyond the $13,000 mark, it seems like the next bull market is here. It can be seen from BTC markets that have been on fire for the last 7 days, including derivatives. The latest data shows that bitcoin futures markets on Binance have clocked the highest 24h BTC futures volumes amongst all platforms. This comes amid the exchange registering $760 million in open interest. Binance Experiences Explosive Bitcoin Futures Market Action Bitcoin rallied...

Read More »#994 Grayscale Ethereum Gigant, Einfluss Bitcoin CME Futures & Peter Schiff Skandal

Hey Informanten, willkommen zur Bitcoin-Informant Show Nr. 994. Im heutigen Video geht’s um folgende Themen: Grayscale der Ethereum Gigant, Einfluss von Bitcoin CME Futures auf den Preis & Bank von Peter Schiff Geldwäsche Skandal. [embedded content] 1.) Grayscale der Ethereum Gigant? Unternehmen kauft 2% aller ETHhttps://cryptomonday.de/grayscale-der-ethereum-gigant-unternehmen-kauft-2-aller-eth/ 2.) Closing the gap: The effect of CME Bitcoin futures on Bitcoin...

Read More »Bitcoin Futures Open Interest at 1-Month High

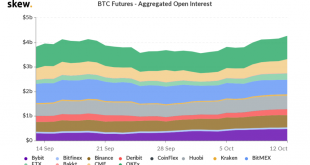

In a suddenly galvanizing rally, Bitcoin’s price shot to the $11,700 mark last night. Open interest has soared and is now at a 1-month high. Bitcoin traders are opening long positions and this trend was pointed by Willy Woo as well.At $4.3 Billion, Bitcoin Futures Open Interest Tops 1 Month HighAlso, a noticeable trend is a rise in aggregated open interest (OI) on different bitcoin futures trading platforms. Yesterday the figure touched a one-month high of $4.3 billion as per Skew.Bitcoin...

Read More »Crypto Derivatives September’s Recap: Binance Futures Leading As BitMEX Down 30%

Although the cryptocurrency spot and derivatives trading volume declined on most platforms in September, Binance has taken the lead as the largest derivatives exchange, a new report revealed.Simultaneously, the regulated Chicago Mercantile Exchange (CME) saw steady Bitcoin futures performance, while the options trading exploded.Binance Takes The Top Spot For Derivatives TradingThe data analytics company CryptoCompare explores the performance of the most popular digital asset exchanges on a...

Read More »Binance Futures Open Interest Crossed $1 Billion In August

Binance’s monthly trading report for August was just released. Data from the report points to striking growth trends in the world’s largest cryptocurrency exchange.However, the key takeaway that stood out was open interest touching the $1 billion mark for the first time since the launch of Binance’s crypto futures trading platform.Crypto Futures Open Interest Tops $1 Billion On BinanceAs per the August trading report, Binance’s crypto futures platform recorded an all-time high open-interest...

Read More »Bitcoin Futures Open Interest at ATH Above $5 Billion But Sentiment’s Shaky

Bitcoin futures aggregated open interest hit the $5 billion mark yesterday, but the overall trend seems to be declining.This points to a possibility that BTC derivative traders are quitting the market owing to lackluster price action. Will a gap at the $9700 price level result in a proliferation of short positions?Bitcoin Futures Open Interest Drops Post Topping $5 BillionData from UK based market analytics firm Skew shows that the aggregated open interest in Bitcoin futures trading hit an...

Read More »Binance Encounters Problems with Its Bitcoin Futures

Binance – the world’s largest and most prominent cryptocurrency exchange by market cap – has been experiencing a few problems over the past few days. It looks like one customer’s trading activities is responsible for sending the price of certain bitcoin futures up into the $100K range.Binance Deals with a Naughty CustomerBinance chief executive Changpeng Zhao explained in a tweet:Another day in crypto. A user’s [algorithm] went ballistic and sent multiple orders to achieve this.The good news...

Read More »BTC Futures Trading on Bakkt Surges

It looks like Bakkt is experiencing a sudden surge in business.Bakkt Is Pulling a Few Unexpected PunchesRecently, it was reported that the institutional crypto trading platform owned and governed by the Intercontinental Exchange (ICO) was doing rather poorly as of late, having traded zero bitcoin options since mid-June. Now, more than 30 days later, that still hasn’t changed.However, the platform has witnessed a surge in bitcoin futures trading. Just last Monday alone, Coin Market Cap...

Read More » Crypto EcoBlog

Crypto EcoBlog