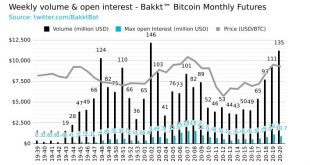

The Intercontinental Exchange (ICE) backed Bakkt has just reported its largest single-day volumes for physically settled monthly Bitcoin futures contracts. On Monday, the figure hit a new record, trouncing the previous one. “Our Bakkt Bitcoin Futures reached a new record high of 11,509 contracts traded today – an increase of 85% from our last record-setting day,” – Bakkt tweeted. Physically-settled contracts are paid out in BTC as opposed to cash-settled ones that get delivered in USD....

Read More »Bitcoin Futures Open Interest on BitMEX is Over $1 Billion, Data Shows

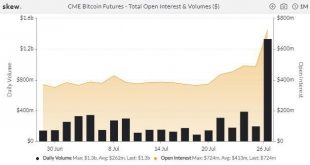

Open interest for Bitcoin Futures on major derivatives crypto exchange BitMEX reached an all-time-high (ATH) as it crossed the $1 billion milestone. The record high happened for the first time since the crypto market crashed back in March 2020.Bitcoin Futures Open Interest on BitMEX at 4-Month HighAccording to data from crypto derivatives market data provider Skew, the open interest on Bitcoin Futures on BitMEX crossed the $1B landmark for the first time since Black Thursday. Across the...

Read More »Poloniex Joins the Party: Launching 100x Leverage Bitcoin Futures Platform

Poloniex, one of the veteran cryptocurrency exchanges, will be joining the derivatives party. The venue has launched Poloniex Futures – a platform that allows traders to use BTC perpetual swaps with USDT as collateral and up to 100x leverage.Poloniex Joins the Bitcoin Futures PartyAccording to an official release dated July 11th, Poloniex has announced the launch of its Futures trading platform.Following the launch, traders will be able to adequately long or short Bitcoin using a leverage...

Read More »Binance Ordered To Stop Offering Derivatives Trading Products In Brazil

Brazil’s CVM Says no to Binance Futures Trading: In a statement released on Monday, the Comissão de Valores Mobiliários (CVM) — Brazil’s securities regulator — announced the ban on Binance crypto derivatives trading in the country. According to the CVM, Binance is not authorized to offer securities trading in Brazil.For the CVM, crypto derivatives constitute a securities offering regardless of whether the underlying asset like Bitcoin (BTC) is not a security. Following the statement, Binance...

Read More »VP of Binance Futures, Aaron Gong: We Saw 217% Institutional Clients Increase In Q1 2020 (Exclusive Interview)

Binance is currently the world’s leading cryptocurrency exchange by means of the trading volume. Launched in 2017, the company has managed to become a standard in the industry quickly.Despite its fast phase growing, the giant exchange launched Binance Futures, the cryptocurrency derivatives trading platform of Binance, only in September 2019. Binance Futures allows users to trade Bitcoin and leading altcoins with leverage as high as 125x.In the months following the launch, Binance Futures...

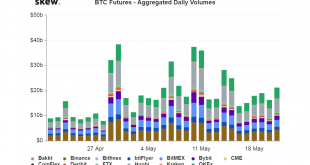

Read More »Crypto Derivatives Monthly Volume At New All-Time High: Binance Ahead of BitMEX

Cryptocurrency derivatives trading volume reached a new monthly all-time high in May 2020, surpassing the previous record recorded in March, recent research indicates. Volumes on regulated exchanges such as CME soared as well for both futures and options trading. Crypto Derivatives Monthly Volume ATH According to the report by CryptoCompare, the monthly trading volume of cryptocurrency derivatives surged by 30% in May. It hit a fresh all-time high of $602 billion, beating the previous record...

Read More »All Funds Are SAFU: BitMEX Outage On Tuesday Due To Server Restart

The veteran Bitcoin margin trading exchange BitMEX went down for over an hour a few days ago. While the community speculated on several plausible reasons, BitMEX published a post today explaining what happened, how they can prevent similar occurrences in the future, and assuring that all customer funds are safe.Why BitMEX Went DownThe platform “experienced unscheduled downtime” on May 19th between 12:00 UTC and 13:40 UTC. In the blog post from earlier today, BitMEX explained that it was “a...

Read More »Bakkt Expands Loyalty Program, Increases Insurance Coverage, and Onboards 70 New Clients

Bakkt, the Bitcoin futures contract platform of the Intercontinental Exchange (ICE), has partnered with an insurance broker to increase its coverage by an additional $500m. The company also announced the onboarding of 70 new institutional clients and the expansion of its loyalty program.Bakkt Increased Its Insurance CoverageEarlier today, Bakkt’s President Adam White shared a blog post regarding the latest developments coming from the firm. Firstly, Bakkt has partnered with Marsh – one of the...

Read More »Bitcoin Dump Post Halving Will Be Caused By Exchanges Themselves, Says Willy Woo

Another popular cryptocurrency analyst believes that it’s entirely plausible the price of Bitcoin to plunge following the halving. He argued that exchanges offering futures trading will induce the biggest sell pressure on the market.BTC Price To Drop Because Of ExchangesWith the third Bitcoin halving scheduled to take place only a few days from now, speculations regarding potential price effects continue to spiral. Popular on-chain analyst, Willy Woo, believes that after the event, miners...

Read More »CME Bitcoin Options Record All-Time High Of Nearly $10 Million Daily Traded Volume

A record-breaking number of 210 Bitcoin options contracts were traded yesterday on the Chicago Mercantile Exchange, which set up a new all-time high of nearly $10m. Of the total amount, 202 contracts were May calls (bullish), while 8 were May puts (bearish).CME Bitcoin Options Volume On The RiseCME launched options on Bitcoin in January this year. Despite a promising start with massive volumes, the platform has struggled to maintain consistent numbers of traded contracts.Moreover, following...

Read More » Crypto EcoBlog

Crypto EcoBlog