Bakkt, the Bitcoin futures contract platform of the Intercontinental Exchange (ICE), has partnered with an insurance broker to increase its coverage by an additional 0m. The company also announced the onboarding of 70 new institutional clients and the expansion of its loyalty program.Bakkt Increased Its Insurance CoverageEarlier today, Bakkt’s President Adam White shared a blog post regarding the latest developments coming from the firm. Firstly, Bakkt has partnered with Marsh – one of the most popular companies providing insurance broking and risk management – to increase its total coverage:“Beyond the 5m of insurance already in place at the Bakkt Warehouse, customers can now purchase more than 0m in additional insurance coverage, subject to underwriting criteria.”The post also

Topics:

Jordan Lyanchev considers the following as important: AA News, bitcoin futures, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bakkt, the Bitcoin futures contract platform of the Intercontinental Exchange (ICE), has partnered with an insurance broker to increase its coverage by an additional $500m. The company also announced the onboarding of 70 new institutional clients and the expansion of its loyalty program.

Bakkt Increased Its Insurance Coverage

Earlier today, Bakkt’s President Adam White shared a blog post regarding the latest developments coming from the firm. Firstly, Bakkt has partnered with Marsh – one of the most popular companies providing insurance broking and risk management – to increase its total coverage:

“Beyond the $125m of insurance already in place at the Bakkt Warehouse, customers can now purchase more than $500m in additional insurance coverage, subject to underwriting criteria.”

The post also indicates that Bakkt is expanding its institutional custody business to more than 70 clients.

The company has also undergone two audited reviews. One of the Big Four accounting organizations, KPMG, has completed a SOC 1 Type I and a SOC 2 Type II examination of the ICE infrastructure.

Upon the completion of both, the popular crypto prime broker, Tagomi, selected Bakkt as its preferred Bitcoin custodian. Thus, Tagomi clients “can now custody with Bakkt for 0.1% per year.”

Earlier this year, the company acquired a leading provider of loyalty solutions – Bridge2 Solutions. In the post from today, the company added that it has partnered with two other financial institutions and is now offering loyalty services to over 30 million consumers.

In its statement, White also touched upon the upcoming launch of the Bakkt app. It now allows users to sign up and to receive early access before the official release of the app later this year. However, the exact time has not been disclosed yet.

Bakkt Trading Volumes

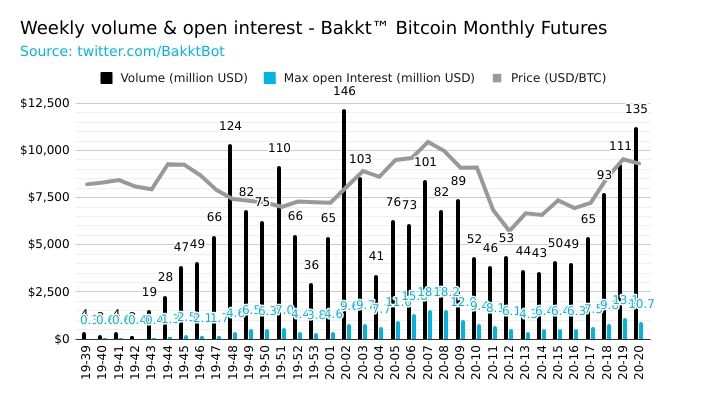

These latest developments come after a certain challenging period for the company. Aside from having to appoint its third CEO in the past several months, Bakkt’s BTC futures platform marked several consecutive weeks of relatively low trading volumes.

After reaching an all-time high level in early January, the volumes decreased, particularly during the most intense days of the COVID-19 pandemic threat.

However, the Bakkt Trading Bot illustrates now that the platform is experiencing surging volumes lately. Moreover, it just registered its second-best weekly result for its monthly futures with $135m, which represented a 21% increase compared to the previous week.