Ireland, Switzerland and Austria generate most of the coronavirus related requests in Europe. They want to know how coronavirus impacts Bitcoin price. The situation looks like both Bitcoin and coronavirus turn out to be risky, yet very profitable investment bet.Per Google Trends, people across the planet are in the search for ‘coronavirus bitcoin’. They show more concerns over the virus’s influence on local areas.Specifically, Canada, Singapore, Germany, and Australia are beating the charts in terms of the request magnitude. The U.S. is in 13th place. During recent months, people have started searching for ‘coronavirus’ more than ‘halving’ in regards to Bitcoin:Photo: CointelegraphEven the Ethereum 2.0 request doesn’t seem to generate such interest as the ‘Bitcoin halving’. On a 12

Topics:

Jeff Fawkes considers the following as important: bitcoin halving 2020, bitcoin price, Bitcoin-Halving, BTC, btc price, crypto, Editor's Choice, News

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Emily John writes Binance CEO Applauds Japan Crypto Rules Amid Reforms

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

Ireland, Switzerland and Austria generate most of the coronavirus related requests in Europe. They want to know how coronavirus impacts Bitcoin price. The situation looks like both Bitcoin and coronavirus turn out to be risky, yet very profitable investment bet.

Per Google Trends, people across the planet are in the search for ‘coronavirus bitcoin’. They show more concerns over the virus’s influence on local areas.

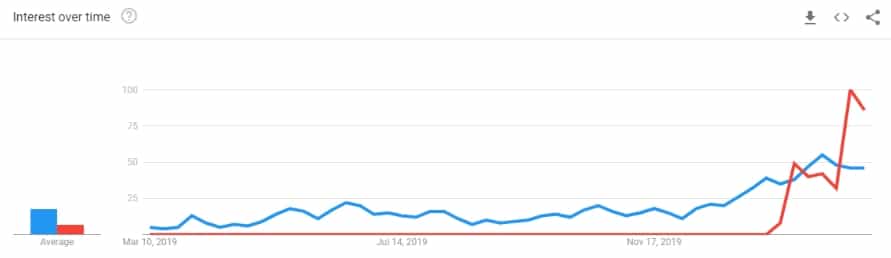

Specifically, Canada, Singapore, Germany, and Australia are beating the charts in terms of the request magnitude. The U.S. is in 13th place. During recent months, people have started searching for ‘coronavirus’ more than ‘halving’ in regards to Bitcoin:

Photo: Cointelegraph

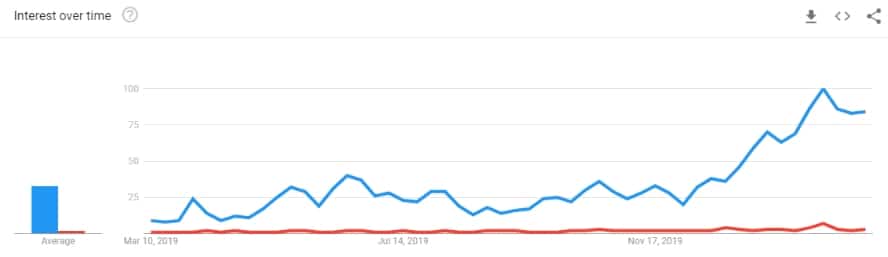

Even the Ethereum 2.0 request doesn’t seem to generate such interest as the ‘Bitcoin halving’. On a 12 month-long average graph representing ‘Bitcoin halving’ and ‘ETH 2.0’ calls, the Bitcoin halving request gains 90-95% more of the traffic interest.

Photo: Cointelegraph

Worth noting that Bitcoin halving as the reason for concerns increases its traffic over time. The event seems like gaining popularity because people want to know more about the technology and its metrics. The metrics are surely very complicated, so it’s not a big blow that folks refresh facts about the event. Also, many people never experienced the halving, which is the reason behind ‘Bitcoin halving’ request traffic gain.

Many of the cryptocurrency news outlets working on the SEO more than journalism will presumably post out a hefty of ‘optimized’ pieces. No matter what, the virus seems like something that is going out of control. And there are not so many things on this planet going out of control. We are comfortable with big people making all the important decisions for everybody. However, the most interesting game is the one where no one can change the rules after it begins.

Bitcoin and Coronavirus Are Two Unexpected Games

The issue with Bitcoin’s popularity among VC’s – its unpredictably high volatility. You can set up a ton of signals and trading alerts, and bots. You can drink red bull, eat pizza and forget the sleep and trade all night. But you will never guess where the price will land the next day. There are millions of price forecasts on the web. Half of them turned out to be bullshit.

This means Bitcoin is such an attractive investment because you can make an honest bet on it. You cannot make any significant bets on the gold market without fearing the whales. When you buy silver, oil, bonds, or Treasuries, or even Apple Inc (NASDAQ: AAPL) stocks, you know that the price action will remain within a certain frame. Whales only play with volatility when there is certain news on the market or some war starts off. It seems almost impossible that Tesla Inc (NASDAQ: TSLA) stocks go to zero in two to three days, for instance. Such a situation is common in cryptocurrency markets though. Some of the ICO coins can tank to zero in three hours, not even days.

Coronavirus is the second worldwide economic factor making people think of life meaning. Just like Bitcoin, coronavirus is acting unexpectedly, and people have no idea what it will do next time. Maybe it will burn down the world economy in six months? A much shorter term than Bitcoin proponents suggested for the cryptocurrency revolution. While the virus is racing around the planet, many stay concerned about the possible gains it could provide to the smart deal makers.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.