The use of cryptocurrencies in Venezuela has thrived over the years, and although they may not be the revolution that many expected, they have managed to fit into the financial thinking of the people there more strongly than in other countries.The status of crypto and blockchain technology in the country has evolved significantly. A recent report by the blockchain forensics firm Chainalysis concluded that the South American country’s financial crisis catalyzed a greater interest and openness among the people to become involved with crypto.Under these circumstances, cryptocurrency has taken on an important role in Venezuela’s economy,” says the report, “in fact, Venezuela’s cryptocurrency market represents a confluence of several topics at the core of cryptocurrency’s key value propositions

Topics:

George Georgiev considers the following as important: AA News, Blockchain Adoption, BTCEUR, BTCGBP, btcusd, btcusdt, Venezuela

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The use of cryptocurrencies in Venezuela has thrived over the years, and although they may not be the revolution that many expected, they have managed to fit into the financial thinking of the people there more strongly than in other countries.

The status of crypto and blockchain technology in the country has evolved significantly. A recent report by the blockchain forensics firm Chainalysis concluded that the South American country’s financial crisis catalyzed a greater interest and openness among the people to become involved with crypto.

Under these circumstances, cryptocurrency has taken on an important role in Venezuela’s economy,” says the report, “in fact, Venezuela’s cryptocurrency market represents a confluence of several topics at the core of cryptocurrency’s key value propositions and risk factors.

These political, financial, and economic factors have allowed the crypto ecosystem to grow in acceptance, mainly thanks to the rise of Bitcoin and the government’s efforts to promote the use of Petro, a state-sponsored cryptocurrency.

Bitcoin’s Growth in Venezuela

According to Chainalysis, Venezuela has one of the world’s highest crypto adoption rates, with a score of 0.80 on a scale of 0 to 1. In Venezuela, crypto has served not only as a store of value in the face of the sharp devaluation of the Bolivar but also as a means for the people to send and receive money bypassing the economic sanctions imposed by the U.S. government

The country has reached one of the highest rates of cryptocurrency usage in the world, placing third on our Global Crypto Adoption Index, as many Venezuelans rely on cryptocurrency to receive remittances from abroad and preserve their savings against hyperinflation.

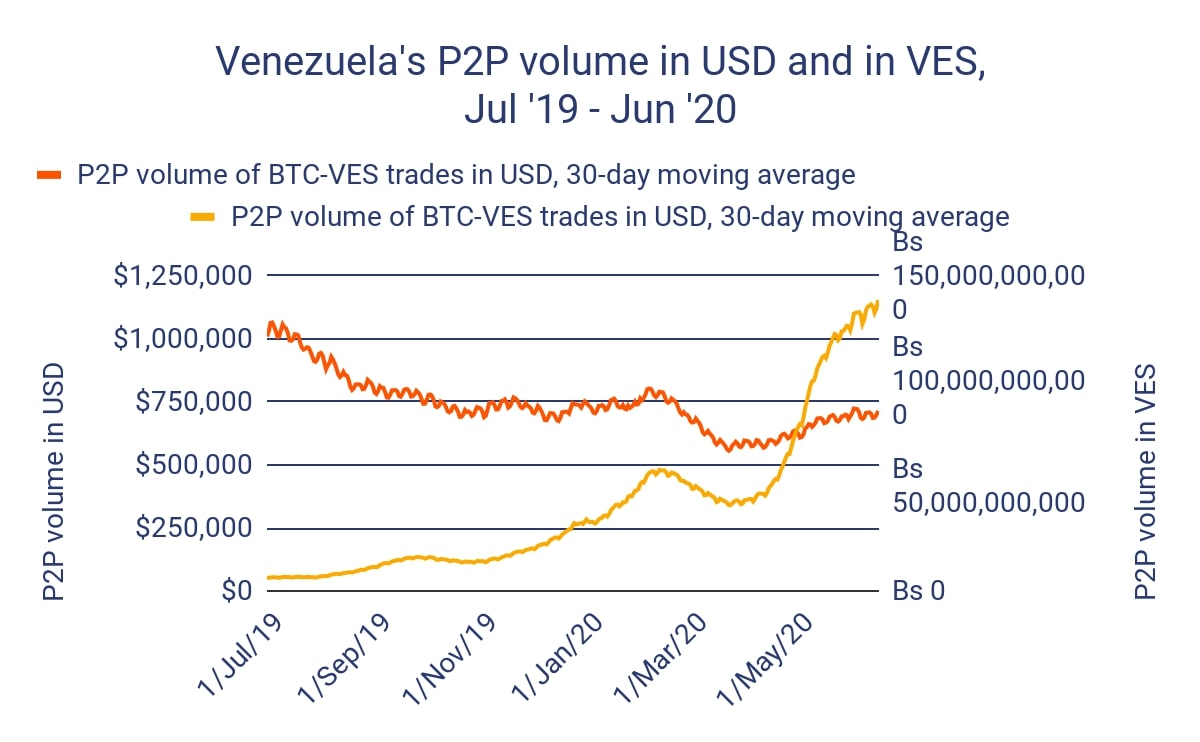

Chainalysis also explains that the number of trading operations has grown. Currently, Venezuelans trade more Bitcoin than any country other than the United States and Russia. Still, the metrics are complex to determine because the rampant inflation made it very difficult to establish how much this represented in the daily life of a typical Venezuelan trader.

The Petro Hasn’t Taken off but Helped Strengthen the Crypto Ecosystem

Another factor highlighted by Chainanalysis is the Venezuelan government’s efforts to promote the use of Petro as an alternative to the traditional financial system.

The Petro is a token announced in 2017 with two fundamental goals: to combat the devaluation of the Bolivar and to tackle the economic sanctions against Venezuelans. And although so far it has not been able to fulfill either of these objectives, its deployment served for many Venezuelans to familiarize themselves with the concept of crypto and blockchain technologies.

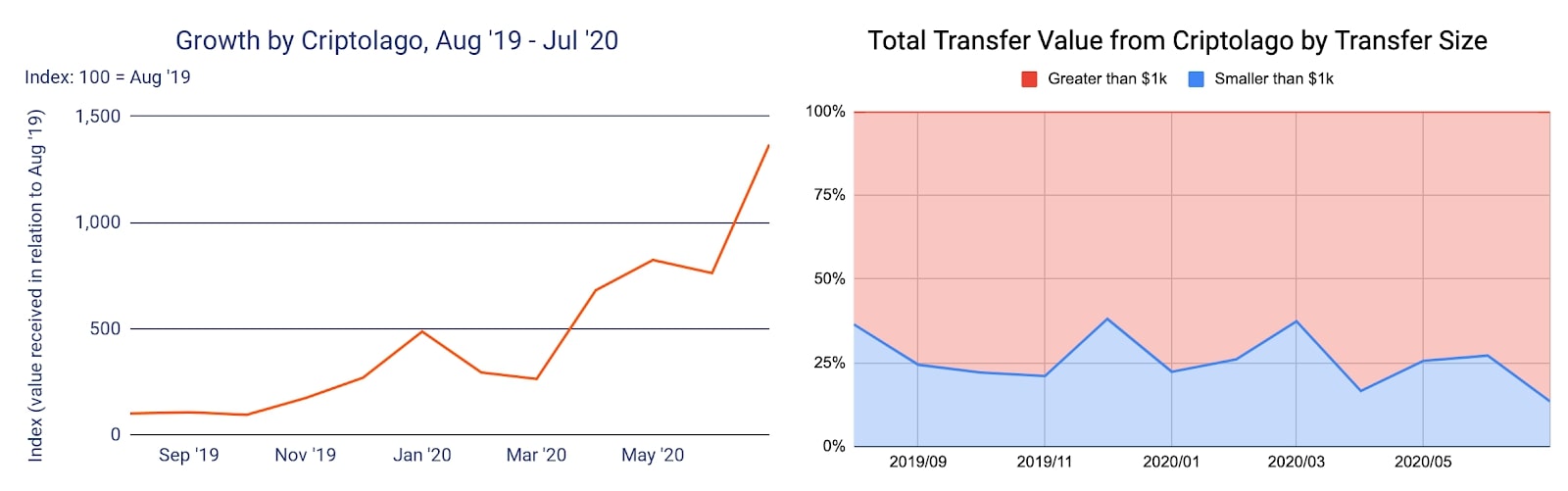

To promote the adoption of Petro, the government granted licenses to 7 exchanges: Criptolago, Bancar, Amberes, Cryptia, Afx, Criptomundo, and CriptoEx. These support Petro and other crypto pairs, so they have served to promote the trading of cryptocurrencies in the country.

But there is a curious fact. Although there has been an explosion in the number of users and transactions, fiat volume has remained relatively stable.

This could be a reflection of how the substantial devaluation has led traders to make more transactions in bolivars to move the same amount in dollars, or it could indicate a money laundering scheme by individuals with financial resources. Moises Rendon, a Venezuela expert at the Center for Strategic & International Studies (CSIS), told Chainanalysis.

“I suspect that most of the users of this platform are people close to the Maduro regime or otherwise able to take advantage of Venezuela’s corruption to make money – the large transfers on Criptolago are likely them trying to preserve this wealth or move it somewhere to evade sanctions, as most of these high profile Venezuelans can’t open bank accounts in other countries.”

The conclusions showed on the report back what other experts also found. Perhaps it is not crypto per se that is on Venezuelans’ minds, but the current financial crisis has paved the way for people to seek alternatives to the financial system. In Venezuela, Bitcoin is just one of the many possible answers.