For the past month, BTC’s volatility had decreased compared to the previous months. The primary cryptocurrency had mainly traded inside a K range between ,000 and ,000. Over the past week, Bitcoin reached the upper boundary of that range at K; however, the news coming from BitMEX charged by CFTC, along with President Trump’s hospitalization, sent Bitcoin to .4K last Thursday, which marked the weekly lowest price. So far, this weekend had been slightly positive, as BTC reclaimed ,500. The latter is a significant key level in the 2020 bull-market. ,500 was the previous high for most of this year, and since breached, the level became a critical support line. Despite the above, we do expect Bitcoin’s price to follow once Wall Street Futures get into play.

Topics:

Yuval Gov considers the following as important: Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

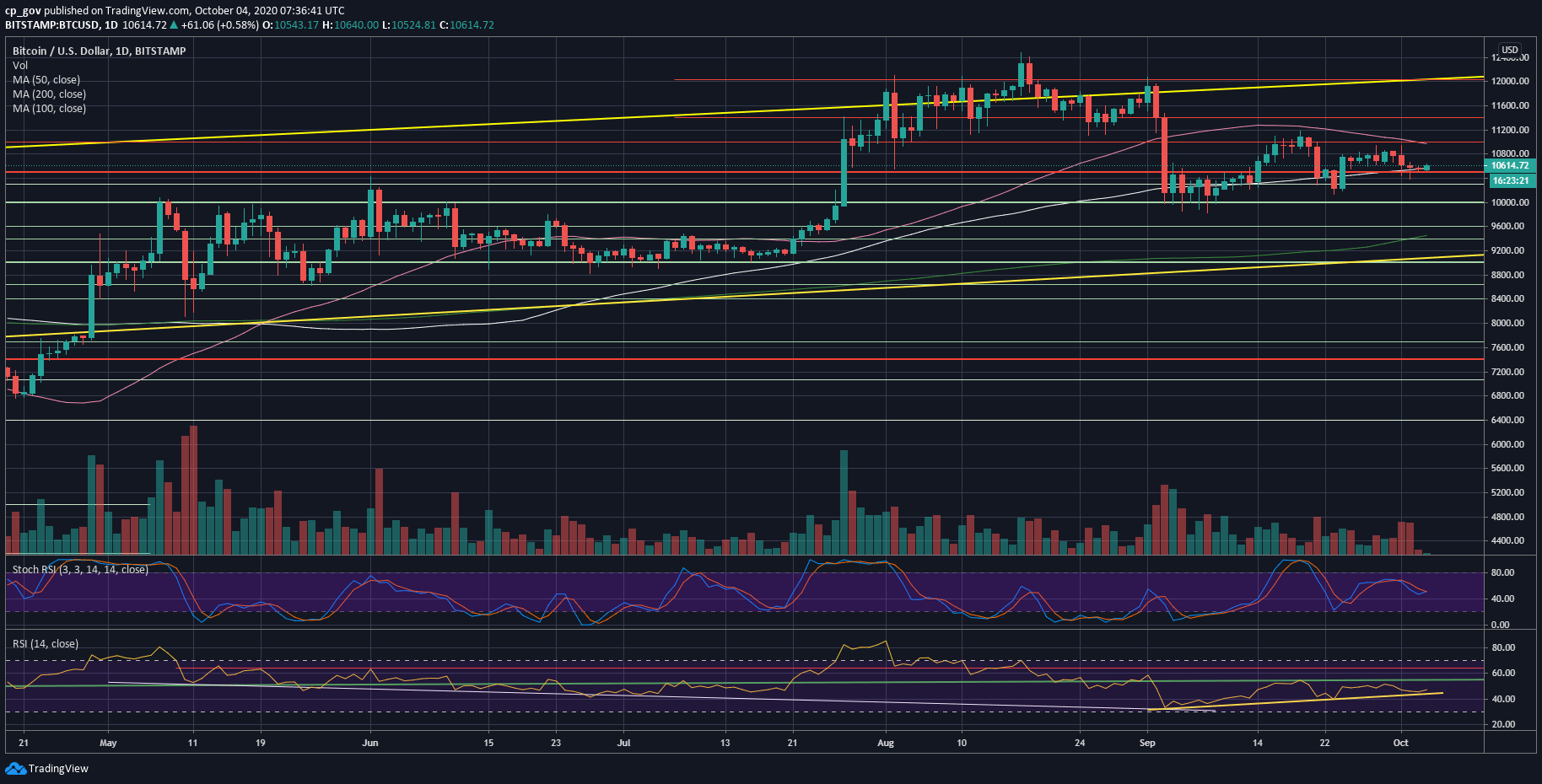

For the past month, BTC’s volatility had decreased compared to the previous months. The primary cryptocurrency had mainly traded inside a $1K range between $10,000 and $11,000.

Over the past week, Bitcoin reached the upper boundary of that range at $11K; however, the news coming from BitMEX charged by CFTC, along with President Trump’s hospitalization, sent Bitcoin to $10.4K last Thursday, which marked the weekly lowest price.

So far, this weekend had been slightly positive, as BTC reclaimed $10,500. The latter is a significant key level in the 2020 bull-market. $10,500 was the previous high for most of this year, and since breached, the level became a critical support line.

Despite the above, we do expect Bitcoin’s price to follow once Wall Street Futures get into play. Hence, it’s no coincidence that the volume is minor, and the price is so far stable.

BTC Levels to Watch in The Short-Term

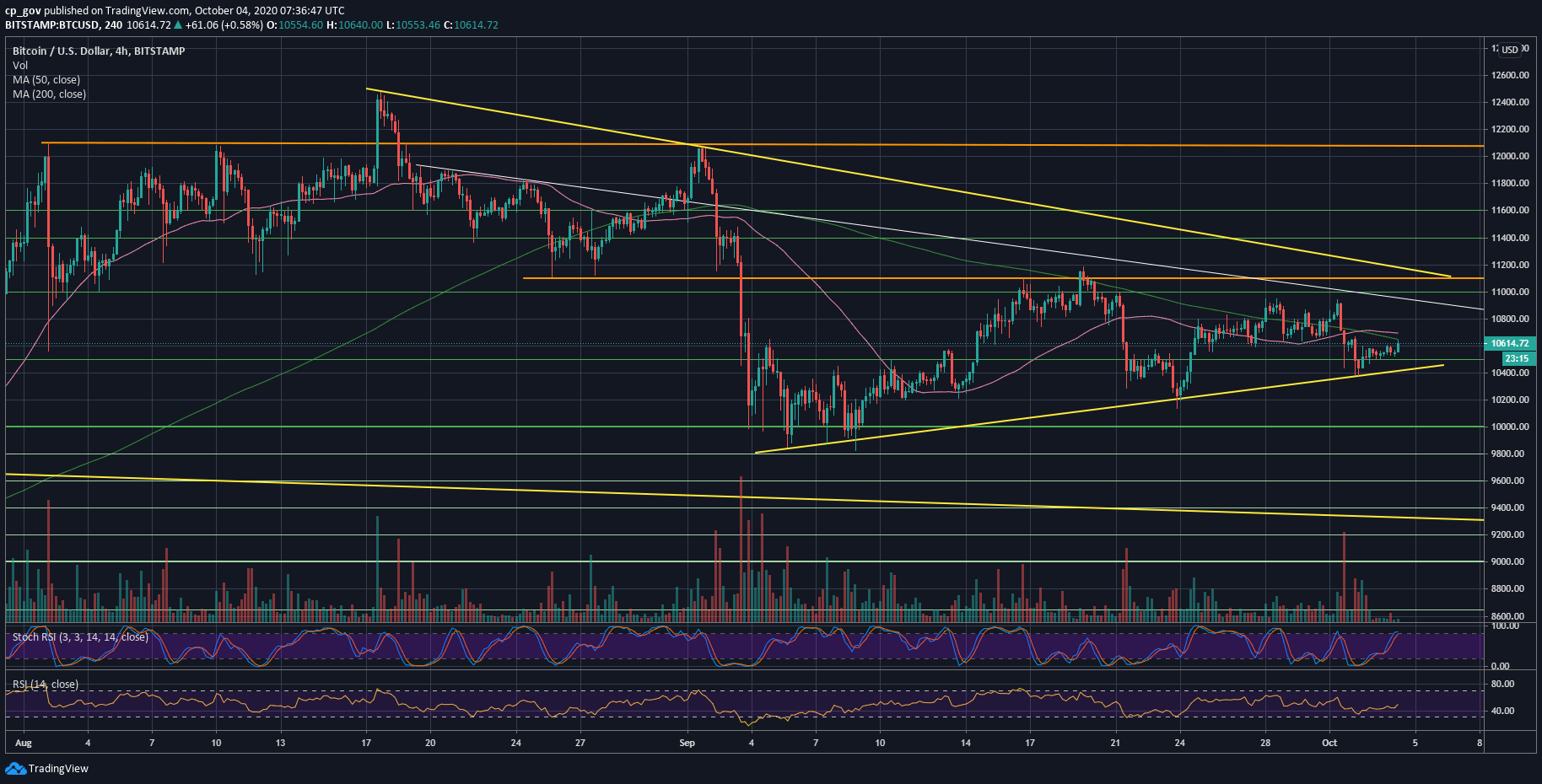

As mentioned above, the critical level here is $10,500, followed by $10,400 (along with the yellow ascending trend-line on the 4-hour chart). On the following daily chart, there were only two days in September with a full body below that crucial range.

We can assume that losing that area of support will quickly send Bitcoin to the next support at $10,200, before retesting the next major area at $9900 – $10,000.

From above, the major level of resistance is the latest high around $11,000, which also contains the 50-days moving average line (marked pink).

The bottom line is that the situation looks indecisive, as Bitcoin eyes the equity markets’ futures and will likely act accordingly.

Total Market Cap: $343 billion

Bitcoin Market Cap: $196 billion

BTC Dominance Index: 57.3%

*Data by CoinGecko