Dmitriy Gurkovskiy, a senior analyst at foreign exchange broker RoboForex, shares his insights into the future scenarios for Bitcoin price movement as well as possible price swings of major altcoins.The market may be returning to an uptrend. The Bitcoin demonstrates confident growth, executing a reversal pattern. The aim of the growth may be the area near 400. Other coins are also trying to rise. The leader here is the Bitcoin SV that has escaped a flat. As a rule, at such moments the price growth to the width of the range, which may not be the limit of future growth. The Ethereum and EOS also look ready to rise after an insignificant correction. The XRP D1 also looks interesting, with the aim of growth at %excerpt%.38 as the execution of an ascending pattern.BitcoinOn D1, the quotations are

Topics:

Dmitriy Gurkovskiy considers the following as important: Bitcoin SV, BSV, BTC, crypto analysis, crypto price, crypto price analysis, Cryptocurrency News, EOS (EOS), ETH, Guest Posts, News, Reports, roboforex, XRP, XRP (XRP)

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bitcoin Schweiz News writes BlackRock bringt Bitcoin-ETP nach Europa – Was bedeutet das für den Kryptomarkt?

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Dmitriy Gurkovskiy, a senior analyst at foreign exchange broker RoboForex, shares his insights into the future scenarios for Bitcoin price movement as well as possible price swings of major altcoins.

The market may be returning to an uptrend. The Bitcoin demonstrates confident growth, executing a reversal pattern. The aim of the growth may be the area near $12400. Other coins are also trying to rise. The leader here is the Bitcoin SV that has escaped a flat. As a rule, at such moments the price growth to the width of the range, which may not be the limit of future growth. The Ethereum and EOS also look ready to rise after an insignificant correction. The XRP D1 also looks interesting, with the aim of growth at $0.38 as the execution of an ascending pattern.

Bitcoin

On D1, the quotations are trading in an ascending impulse. The Moving Averages point at a bearish trend, but the price has broken them upwards, which suggests strong pressure from the buyers. As the main trading idea, we should expect a test of the broken trendline at $8455, from where the price may show further growth to the potential aim at $12400. This idea is supported by an ascending Wolfe Wave forming on the chart. The second signal of growth is a breakout of the descending trendline on the RSI. The positive scenario may no longer be valid in the case of falling below $5900, which will cancel the pattern and entail further falling with the first aim at $4375.

Photo: Roboforex / TradingView

On H4, the market has virtually executed an inversed Head and Shoulders pattern. We can also see the price grow well here, the quotations have escaped the descending channel. As a short-term trading idea, we should expect a correction with a test of the broken channel border at $7700 and further growth with the first aim at $9800. A strong signal confirming this scenario will be a bounce off the support line on the RSI. The scenario may no longer be valid if the price falls and secures below $6875, which will signify further development of a downtrend.

Photo: Roboforex / TradingView

Ethereum

On D1, the quotations have managed to break out the upper border of the Bollinger Bands, which makes the end of the descending impulse probable and shows strong bullish pressure. A good signal confirming further growth will be a breakout of the descending resistance level on the RSI. However, its values are testing the overbought area, which may provoke a correction before the strong growth of the asset. So, a test of the support level $155 and further growth with the first aim at $202 should not be excluded. The growth will be confirmed by a breakout of the upper border of the descending channel and securing above $175. The scenario may be canceled if the quotations fall below $125, which will mean a potential test of $100 and further development of the downtrend.

Photo: Roboforex / TradingView

On H4, there is a potential for an inversed Head and Shoulders to form with the right shoulder to complete near $130. After this correction, we should expect strong growth with the first aim above $240. Yet another signal confirming the growth will be a test of the support line on the RSI. The ascending impulse will be confirmed by a breakout of the area around $180, which will mean an escape from the descending channel. The described scenario may no longer be valid in the case of strong falling below $120, after which the falling should continue.

Photo: Roboforex / TradingView

EOS

On D1, the quotations have secured above the upper border of the Ichimoku Cloud, which indicates a bullish trend. Currently, we should expect the price to return to the broken border of the indicator with a test of $3.30 and further growth to the aim of $4.87. A strong signal confirming further growth will be a bounce off the trendline on the RSI. The scenario may be canceled by falling and securing below $2.92, which will mean a breakout of the lower border of the Ichimoku Cloud and further falling.

Photo: Roboforex / TradingView

On the smaller timeframes, the price is moving inside a strong ascending impulse. The quotations have escaped the descending channel, which means strong pressure from the buyers. We should expect a test of the broken border of the channel near $3.30 and further growth with the first aim at $4.29. Another signal will be a test of the support line on the RSI. The scenario may be canceled by falling below $2.90, after which we should expect a decline to $2.07.

Photo: Roboforex / TradingView

XRP

On D1, the quotations demonstrate insignificant growth. Currently, there is a potential for further price growth as an execution of the ascending Wolfe Wave pattern. The aim of the growth is $0.38. A good signal confirming this scenario may be a breakout of the upper border of the pattern. On the other hand, we can see a test of the resistance line on the RSI, which indicates the possibility of a decline from the current levels. The aim of the falling may be $0.18, after which only we should expect growth. The scenario, positive for the buyers, may no longer be valid if the price declines and secures below $0.15, which will cancel the pattern and entail further declining.

Photo: Roboforex / TradingView

On H4, the quotations have escaped the descending channel and are testing the resistance area. Here, we can also expect a correction with a test of the upper border of the channel near $0.20 and further growth with the first aim at $0.27. A breakout of it will provoke growth and let the quotations escape the descending channel. The scenario may be confirmed by a test of the trendline on the RSI. The scenario, positive for the bulls, will be falling below $0.17.

Photo: Roboforex / TradingView

Bitcoin SV

On D1, the asset demonstrates aggressive growth. The nearest support level is at $256. The RSI values have broken out the resistance line that now acts as a support line. Currently, we should not exclude an attempt of correction with a test of the nearest support line and further growth with the aim above $500. The scenario may be canceled by falling below $230, which will mean further decline with the aim at $165.

Photo: Roboforex / TradingView

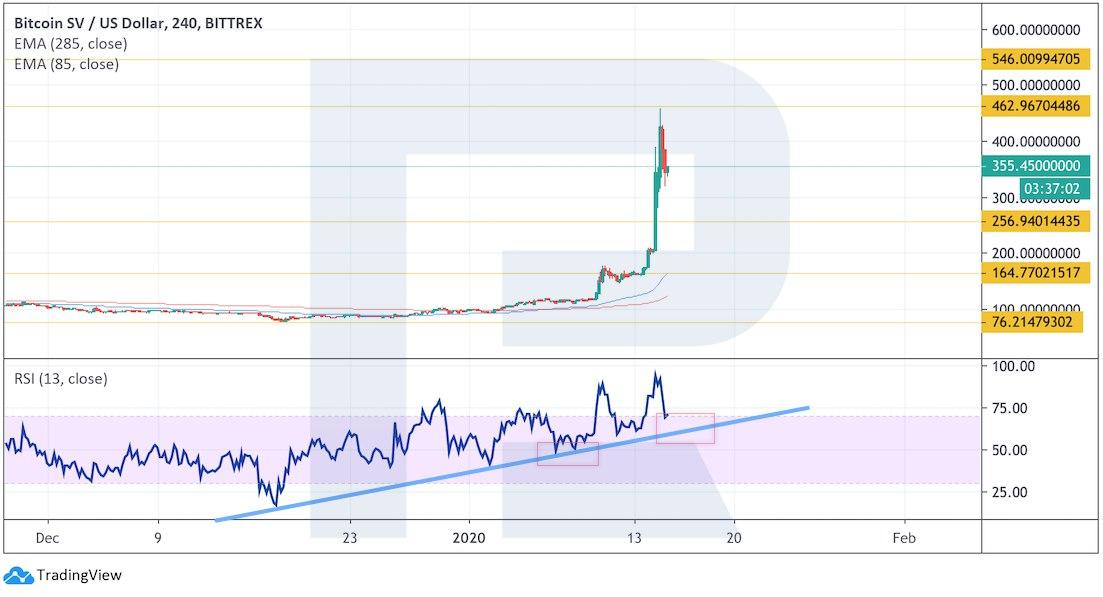

On the smaller timeframes, the price is correcting. Here, we can also see regular bounces off the ascending trendline on the RSI, so we can expect further growth from the current levels to the potential aim at $545. The scenario may no longer be valid if the support level on the indicator is broken out, which will mean the end of the bullish impulse and further decline to $256.

Photo: Roboforex / TradingView

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.