A significant number of Bitcoin investors transferred extensive quantities of their holdings to exchanges during the most notable price slumps in mid-March. Ultimately, most of their panic sales were at a loss, according to the Spent Output Profit Ratio (SOPR) indicator.Bitcoin Investors Rush To Sell In PanicThe popular cryptocurrency monitoring resource, TokenAnalyst, studied the flow of Bitcoin into exchanges around March 12th, when the primary digital asset lost approximately 40% of its value.To obtain the data, they used the indicator – Spent Outputs Profit Ratio (SOPR). It shows the price the investor sold the asset compared to the price he paid when he initially purchased it.If SOPR is above 1, then the owner of the spent output is in profit, and vice-versa.The report stated that

Topics:

Jordan Lyanchev considers the following as important: AA News, Binance, Bitcoin (BTC) Price, okex

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

Bitcoin Schweiz News writes Bitpanda vs. Binance: Welche Bitcoin-App ist die beste für die Schweiz?

Bitcoin Schweiz News writes Binance: Warum diese Bitcoin-Börse die Konkurrenz abhängt!

A significant number of Bitcoin investors transferred extensive quantities of their holdings to exchanges during the most notable price slumps in mid-March. Ultimately, most of their panic sales were at a loss, according to the Spent Output Profit Ratio (SOPR) indicator.

Bitcoin Investors Rush To Sell In Panic

The popular cryptocurrency monitoring resource, TokenAnalyst, studied the flow of Bitcoin into exchanges around March 12th, when the primary digital asset lost approximately 40% of its value.

To obtain the data, they used the indicator – Spent Outputs Profit Ratio (SOPR). It shows the price the investor sold the asset compared to the price he paid when he initially purchased it.

If SOPR is above 1, then the owner of the spent output is in profit, and vice-versa.

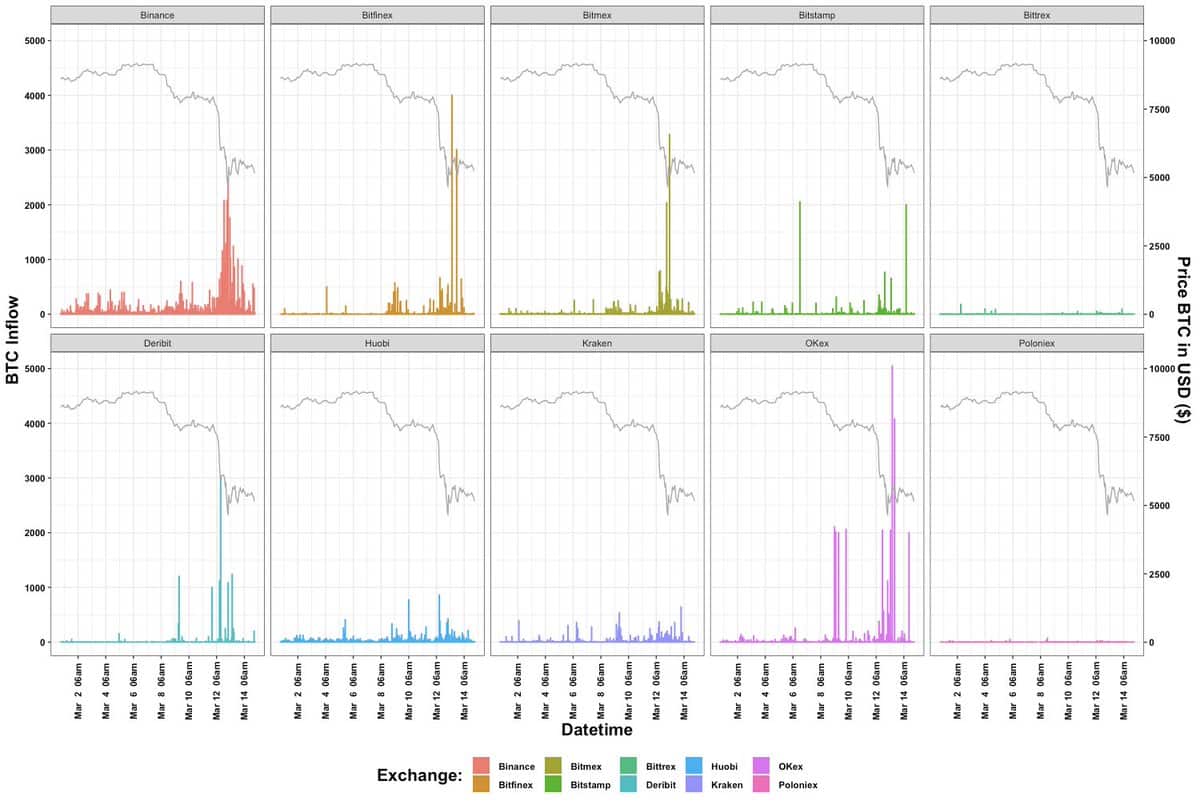

The report stated that when BTC’s violent price development was in motion, numerous investors started transferring their holdings from personal wallets into the most popular exchanges. They followed ten cryptocurrency platforms, and the data revealed that OKEx noted the largest spike during those hours. Bitfinex, BitMEX, Binance, and Deribit also recorded serious inflows.

However, as the graph above indicates, most inflows came when Bitcoin’s price had already plunged below $5,000. As a result, most people sold in panic and at a loss.

Many Losers, Few Gainers

According to the report, OKEx received the most substantial inflow mainly because of 11 deposits totaling around 23,000 bitcoins. They had a created (purchased) price of $12,815 and a deposited price of $6,459. TokenAnalyst concluded that if those quantities were sold immediately at that price, it would “equate to losses of around $146M to the trader.”

Although most investors sold at a loss, there were a few that realized a profit. Back in August 2012, when Bitcoin was trading at around $9, an unknown investor purchased 10 BTC. Eight years later, he deposited them before the price slumps into the leading cryptocurrency exchange by volume, Binance. At the time, Bitcoin was trading at $8,769, and his profit ratio was 963.

When examining the investors’ actions during the massive sell-off, it’s also worth referring to another paper. It revealed that when BTC was tumbling, most sales came from people who had bought their portions in the past few months. Long-term HODLers, on the other hand, didn’t break their stance and kept their holdings.