Digital Currencies like Bitcoin are still far from becoming mainstream, but their growing popularity has been forcing bigger and smaller payments players globally to take a stance. The increasing number of crypto card offerings is indicative. Let’s take a look. Essentially a #cryptocurrency is a form of payment with which people can buy goods and services, however much of the interest has so far been speculative. It’s worth paying attention to crypto card offerings because they signal a shift from speculation to the transactional, payments aspect and, hence, a move in the mainstream direction. There are two main features that today’s evolving crypto card landscape is offering: The ability to pay for goods and services (at stores where Visa and

Topics:

Bitcoin Schweiz News considers the following as important: Bitcoin Cards, BTC, Crypto Card Landscape, FCX Intelligence, Finance, LTC, Payment, software application

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Bitcoin Schweiz News writes Litecoin jetzt in der Telegram-Wallet verfügbar!

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Emily John writes Metaplanet Expands Bitcoin Holdings with .4M BTC Purchase

Digital Currencies like Bitcoin are still far from becoming mainstream, but their growing popularity has been forcing bigger and smaller payments players globally to take a stance. The increasing number of crypto card offerings is indicative. Let’s take a look.

Essentially a #cryptocurrency is a form of payment with which people can buy goods and services, however much of the interest has so far been speculative. It’s worth paying attention to crypto card offerings because they signal a shift from speculation to the transactional, payments aspect and, hence, a move in the mainstream direction.

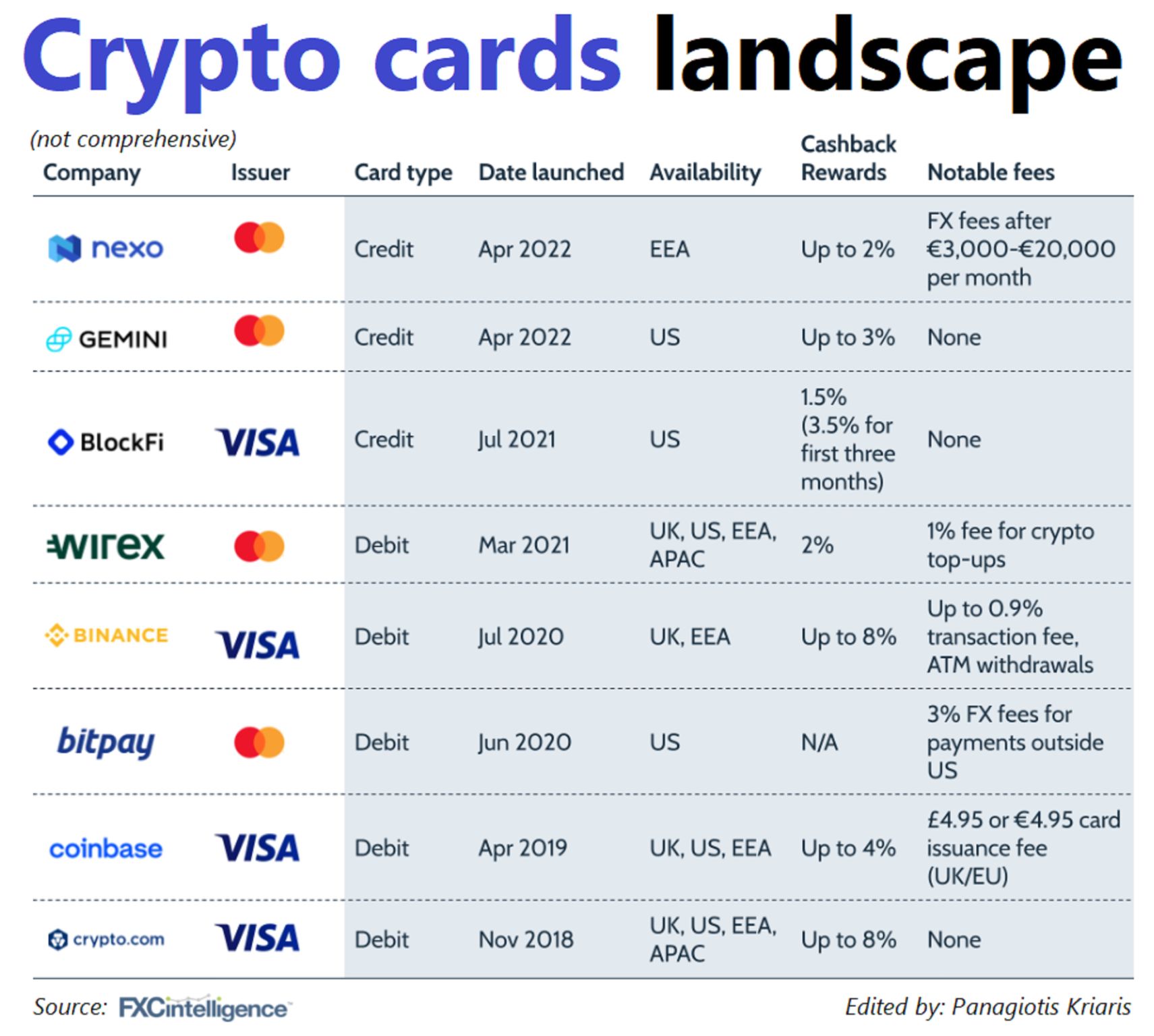

There are two main features that today’s evolving crypto card landscape is offering:

- The ability to pay for goods and services (at stores where Visa and Mastercard are accepted)

- The ability to convert crypto to fiat currency and withdraw these funds in fiat currency as well

A further differentiation needs to be done between (crypto) credit and debit cards:

Crypto credit cards are typically fiat credit cards that are offering their most common incentive – rewards – not in the form of miles, cash or points as typical credit cards do, but in cryptocurrencies, i.e. a percentage translated in bitcoin or some other connected cryptocurrency on the back of every purchase (every card offers selected cryptocurrencies to choose from). The drawback is that these rewards naturally carry the inherent volatility of the originating cryptocurrency (for the reward amount) but there is also the advantage of not having to incur the trading costs associated with buying crypto, which can be also a good starting point or incentive to experiment with owning crypto.

On the other hand, crypto debit cards function in a different way and connect to a user’s cryptowallet, which is the equivalent of a bank account in crypto world (a cryptowallet is essentially a software application that allows its users to store and access their digital assets, i.e. cryptocurrencies). In this way, owners of crypto debit cards can make payments using the funds in their crypto wallets. It needs to be noted that for the transaction to be able to be executed, the conversion of crypto to fiat currency is a pre-condition that automatically takes place as part of the offered functionality.

In an increasingly versatile digital payments arena, the offering of cryptocurrencies has become a tool of choice and diversification rather than one of endorsement, and as such crypto is here to stay. The proliferation of crypto cards is both a sign of maturity and of connection to the traditional finance world, however it should not go unnoticed that we are still at the beginning with structural changes being unavoidable as new players enter the space. Stay tuned!