Featured – Sometimes things go viral that we don’t understand. Consider the YouTube videos of children biting other children’s fingers or covered in paint. Other ideas go viral, as the culture moves at the speed of social media.However, at times, viral concepts occur as a result of something that has powerful underlying implications. Never has this been truer than with the recent announcement of Philippine boxing star Manny Pacquiao.The decentralized selfPacquiao has conceived of the concept of creating his cryptocurrency by which he will offer fans access to himself and his merchandise. Fans will be able to own a tokenized portion of the value in the star’s fame—he will become owned by the fans.Of course, at face value, detractors may have some humorous retorts. For example, banking and

Topics:

Danish Yasin considers the following as important: Projects

This could be interesting, too:

Felix Mollen writes Bitcoin, Cardano, Solaxy Among Biggest Winners From Trump’s US Crypto Reserve Pledge

Felix Mollen writes XRP to as Part of US Crypto Reserve? ADA, BTCBULL Also Bullish

Felix Mollen writes XRP, Ethereum Dip Has Some Whales Eye New Altcoins Best Wallet Token and Human Protocol

Felix Mollen writes Crypto Whales Appear to Be Buying Solana on the Dip, What About Solaxy?

Featured – Sometimes things go viral that we don’t understand. Consider the YouTube videos of children biting other children’s fingers or covered in paint. Other ideas go viral, as the culture moves at the speed of social media.

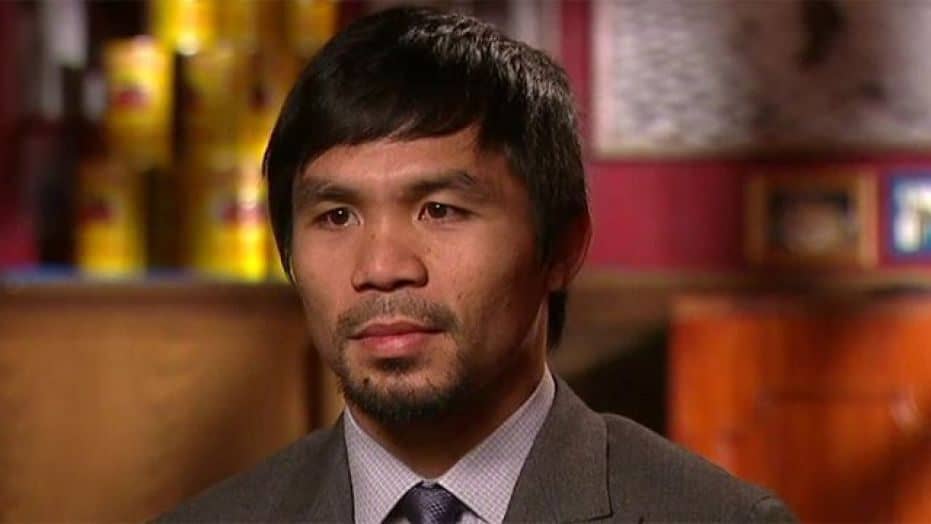

However, at times, viral concepts occur as a result of something that has powerful underlying implications. Never has this been truer than with the recent announcement of Philippine boxing star Manny Pacquiao.

The decentralized self

Pacquiao has conceived of the concept of creating his cryptocurrency by which he will offer fans access to himself and his merchandise. Fans will be able to own a tokenized portion of the value in the star’s fame—he will become owned by the fans.

Of course, at face value, detractors may have some humorous retorts. For example, banking and finance experts would certainly caution would-be investors about the dangers of investing in a sports star. Others would be quick to point out that careers and fame rise and fall with the tides of age and physical prowess.

Nevertheless, the underlying principle of what Pacquiao is doing with self-tokenization is a radically disruptive concept. By offering a means of connecting users (in this case, fans) with any asset (in this case, Manny), the boxer has created a peer-to-peer (P2P) system that removes centralized asset managers – a brilliant move.

And this is becoming more and more a reality. Like blockchain, the technology that undergirds Bitcoin grows in popularity, the fact of tokenization becomes more and more a possibility. Just consider the recent announcement by Wesley Snipes of a tokenized movie as further evidence.

What experts are saying

To grasp the foundational shift that’s happening in technology, experts are always a useful tool. And there is perhaps no firm better to address the change than one who specializes in offering blockchain technology for tokenizing assets.

CPI Tech, a German firm, has created a seamless plug and play solution for firms wanting to incorporate blockchain technology into their platform. What’s more, the firm also offers tokenization abilities for those wishing to issue their cryptocurrencies – exactly what Pacquiao is doing.

According to CPI Tech CEO and Co-Founder, Maximilian Schmidt: “Tokenization is one of the best use cases of blockchain technology. Matching real-world securities and assets like real estate or precious metals with tokens on the Ethereum blockchain will revolutionize how people buy and sell securities and assets. In fact, Manny Pacquiao tokenizing himself is just the beginning of a whole tokenization revolution. Removing the middleman will result in a dramatic decrease in commissions and increase the liquidity in such securities.”

Schmidt makes a clear case for the power of the P2P solution that Pacquiao and Snipes have stumbled upon. By offering investors directly and apportioned access to the asset itself, these systems have removed the costly middleman that has traditionally consumed much of the profitability. While this may seem far-fetched for boxers, it certainly isn’t for securities and assets like real estate and precious metals.

Hurdles?

Of course, the single most significant hurdle for anyone considering the tokenization of an asset is the necessary technology. Blockchain technology is relatively nascent, and experts are often paid a premium, even among their tech counterparts.

However, this is where the CPI Tech solution is masterful. By centralizing the technology component, and then offering the decentralization of the asset itself, CPI Tech becomes the link that makes such offerings possible.

While some things go viral for reasons that have yet to be explained, tokenization seems to be quite different. While only in the beginning stages, it seems likely that this is the next stage in the technology revolution that is already sweeping the way assets and investments are handled.

* Cover image by Fox News