Over the past week, the price of bitcoin has been plummeting with strong bearish momentum, resulting in a break below the 50-day and 100-day moving averages lines on the daily timeframe, indicating that the bears are presently in control of the market. Long-Term: The Daily Chart Technical analysis by Shayan However, the recent price action suggests that the negative momentum had weakened. The price experienced a short-term bullish leg towards $41.6K, which got rejected. But...

Read More »BTC Price Analysis: What’s the Next Critical Support if Bitcoin Loses $40K?

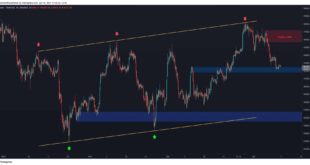

Technical Analysis By: Edris Daily timeframe: Source: TradingViewBitcoin has been dropping impulsively in the past couple of weeks after being rejected from the 200-day moving average. This level has historically acted as a strong resistance during previous bear markets, and the price failing to break back above it may be considered a bad sign. The price has also broken below the 50-day and 100-day moving averages and is currently retesting them from below. These levels...

Read More »BTC Price Analysis: Bitcoin Dips Below $40K For the First Time in a Month, What’s Next?

The 200-day moving average has significantly hindered the recent bullish surge, resulting in a substantial price decline. Bears are currently in control of the market, and the price is plummeting with a strong momentum, which resulted in a break below the 50-day and 100-day moving averages. Technical Analysis The Daily Chart: Technical Analysis By Shayan The $37K and $34K demand zones are the next levels of support for Bitcoin. If the price is supported by the short-term...

Read More »Bitcoin Price Analysis: BTC Rebounded At Key Support, Is The Bottom In?

Bitcoin’s price rally slowed down after getting rejected at the 200-day moving average line amid the $48K range. The 1-Day Timeframe Technical Analysis by Edris The price dropped lower since the MA200 rejection and is currently retesting the 50-day and 100-day moving average lines. These MAs have also printed a bullish cross recently, as the 50-day MA has crossed above the 100-day MA. The $42K level is currently holding the price, is also a significant horizontal support...

Read More »BTC Price Analysis: What’s Next For Bitcoin After the 200MA Rejection?

Despite being up about 5% on the day, BTC’s price took a beating in the past couple of days. It appears that the bulls are attempting to retake control, although the shot at $47K from earlier today has so far been unsuccessful. Technical Analysis By: Edris Daily timeframe: Chart by TradingViewBitcoin’s price is struggling to recover, and it is still trading below the 200-day moving average. This level is one of the most common indicators to determine whether an asset is in a...

Read More »Bitcoin Price Analysis: BTC Gets Rejected, Possible Bearish Scenario on LTF Charts

After almost three months of consolidation, Bitcoin’s price finally broke out of the $33 – $46K range. The Daily Timeframe Technical Analysis By: Edris The price has broken above the $46K resistance zone following a parabolic move and is currently testing the 200-day moving average line (MA) amid $48K. This moving average is a significant trend indicator and if the price breaks above it, the trend would be considered bullish again. The next key resistance lies at the $52K...

Read More »Bitcoin Price Analysis: BTC Finally Breaking Up, But Now Facing Crucial Resistance

It finally happened: After four failed attempts during the first months of 2022, Bitcoin managed to overcome the critical resistance line at $46K and the hope returned to the market. While the bears struggled to defend this area, the bulls were able to take control by liquidating more than $400 million of open positions. Most of the indicators are now in the bullish zone. Technical Analysis by Grizzly The Daily Chart On the daily timeframe, the ROC 30d indicator was able to...

Read More »Bitcoin Facing Critical Resistance – Breakout and $50K Imminent (BTC Price Analysis)

Following a bullish rebound over the past few days, Bitcoin has once again reached the critical resistance zone of $45K. The good news is that the price has broken above the 100-day moving average line, followed by a bullish rally compiled of five green daily candles. The Daily Chart Technical Analysis By Shayan The BTC price is currently aiming for another attempt to break the critical resistance level of $45K. If it succeeds, breaching above the $46K supply zone could be...

Read More »Bitcoin Price Analysis: BTC Facing Critical Decision Following $42K Rejection

Bitcoin is resuming its flat price action, consolidating inside a huge bearish flag. Currently, the price is struggling with the $42K level. In case of a breakout and a higher high above $42K – Bitcoin will likely head towards $46K. The $46K – $48K area is significant from both the classical price action and supply and demand perspectives, as it forms the top trendline of the bearish flag pattern, along with a critical supply zone. The Daily Chart Technical Analysis by Edris...

Read More »Bitcoin Price Analysis: Is $45K in Sight For BTC Following Recent Spike?

Since early 2022, Bitcoin has been in a ranging phase, resulting in two crucial supply and demand levels. There seems to be a lot of demand in the form of bids and stop-losses above $45K, making it a significant level to watch. Technical Analysis The Daily Chart: Technical Analysis By Shayan As the daily chart illustrates, the price has been supported by the significant support level at $37K, which has led to a break out of the RSI’s resistance trendline and now is attempting...

Read More » Crypto EcoBlog

Crypto EcoBlog