Revolut: Screenshot aus der Revolut App Der britische Digitalbanking-App Anbieter Revolut sammelt in einer neuen Finanzierungsrunde mehr als 800 Millionen Dollar ein. Die Bewertung der Neo-Bank steigt damit auf über 33 Milliarden US-Dollar. Damit baut es seine Marktführerschaft in Europa weiter aus. Investiert haben 2 echte Schwergewichte und zwar Softbank und Tiger Global, teilt das Unternehmen mit. Aktien, Bitcoin und bald...

Read More »PayPal Users Can Soon Move Their Crypto to Other Outlets

Crypto fans around the world were excited to hear last October that PayPal would soon be allowing users to purchase and store cryptocurrencies through the trading platform. In addition, PayPal said that it was on the verge of allowing customers to pay for items and services with digital currencies. PayPal Is Changing Things Up a Bit This got things hopping up and down and the bitcoin boom ultimately began, though things came with a catch as users soon began to find out...

Read More »Revolut Will Soon Allow Users to Transfer Their Crypto Assets Elsewhere

In recent months, large payment companies such as Robinhood and PayPal have begun allowing people to purchase bitcoin and other cryptocurrencies through their sites. While people have likely had fun doing so, they have encountered an issue in that some of these firms do not allow users to move their digital money to other platforms. Revolut, a London-based banking app, initially took this approach as well, but is now looking to change form. Revolut Is Changing How It...

Read More »Yapeal: Schweizer Handy-Bank kann jetzt Bitcoin

Yapeal: Leider nur 'mobile only'. Eine Banking App inklusive VISA Debitkarte für die Schweiz. Yapeal bietet ab sofort auch Bitcoin an. In Kooperation mit dem Krypto-Startup will das Fintech nach und nach diverse Kryptowährungen anbieten. Langfristig sollen beide Anwendungen noch enger verschmelzen. Kooperation mit Startup Relai Yapeal ist ein Schweizer Fintech, welches im Jahr...

Read More »Namensänderung: Transfwerwise heisst jetzt Wise

Transferwise wird zu Wise Kurz vor dem geplanten Börsengang benennt das britische Fintech-Unternehmen (*) die Domain „Transferwise“ in „Wise“ um. Grund für den Namenswechsel ist aber nicht nur der bevorstehende Börsengang, sondern die Tatsache, dass die beiden Masterminds hinter der Domain verstärkt darauf aufmerksam machen wollen, dass „Wise“ seinen Kunden eigentlich weit mehr als nur günstige Auslandsüberweisungen bietet. Der CEO von...

Read More »London: Revolut beantragt Banklizenz

Der Schweizer Markt gehört zu den am schnellsten wachsenden Märkten von Revolut in Europa. zusammen mit Ländern wie Italien, Portugal, Irland, Rumänien und Polen. Revolut beantragt eine Banklizenz. Der britische Konto- und Kartenanbieter will künftig auch klassische Bankdienstleistungen wie Kredite und Sparbücher anbieten und möchte daher seine bisherige E-Geld-Lizenz...

Read More »Revolut: Wir stellen Leute ein, in Indien, Brasilien, Mexiko, den Philippinen

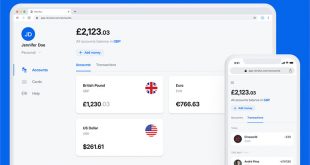

Die Smartphone-Bank Revolut gibt es jetzt auch als Browser-Version. Neun Monate lang herrschte bei Revolut Wachstumsstopp. Aber das soll sich in wenigen Tagen ab em 1. Januar ändern. Nun aber erst der Reihe nach. Die britische Digitalbank konnte ihren Umsatz in den letzten Jahren immer wieder stark steigern, aber keinen wirklichen Gewinn erzielen. Im November 2020 wurde nun,...

Read More »Transferwise plant Börsengang

TransferWise Kreditkarte: Transferwise ist 10 mal günstiger als herkömmliche Banken. Der Überweisungsdienstleister Transferwise (*) ist eines der fünf wertvollsten europäischen Fintech-Unternehmen. Bei dem Unternehmen handelt es sich nicht mehr um ein klassisches Start-up, wie der stellvertretende CEO Kristo Käärmann gern betont. Er ist einer der beiden Gründungsväter und...

Read More »Bitcoin Cash und mehr: Revolut nimmt weitere Kryptowährungen ins Sortiment

Die britische Smartphone-Bank Revolut fügt diese Tage weitere Kryptowährungen hinzu. Das ist jetzt doch sehr überraschend: Revolut fügt seinem Dienst einige weitere Kryptowährungen hinzu. Eigentlich wäre es besser gewesen, erstmal Bitcoin, Litecoin und Ethereum richtig zu integrieren. Sodass die Kunden diese auch richtig und selbstständig versenden und empfangen können. Aber...

Read More »Bitcoin-Branche schafft Jobs

Momentan gibt es fast keine Branche, in welcher Jobs geschaffen werden. Aktuell schaffen lediglich die beiden Branchen Blockchain und Fracking Jobs. Transferwise hat soeben 750 weitere Jobs angekündigt, welche global geschaffen werden. Aber vor allem auch die grossen Bitcoin-Börsen sind wahre Job-Wunder, wie das Magazin Cryptonews in einem Artikel aufzählt. Transferwise startete im Jahr 2011 mit 3...

Read More » Crypto EcoBlog

Crypto EcoBlog