Stellar blockchain is now officially a part of the Samsung Blockchain Keystore. Stellar Development Foundation, a non-profit organization responsible for the cryptocurrency network’s growth and development announced today.It’s a Match for Stellar and SamsungIn a press release shared earlier, the Stellar Development Foundation (SDF) announced the integration of the Stellar blockchain network into the Samsung Blockchain Keystore.This will allow Samsung Galaxy smartphone users to securely store...

Read More »Bitcoin Charges to $9,300 as Altcoins Continue to Boom: Saturday Price Watch

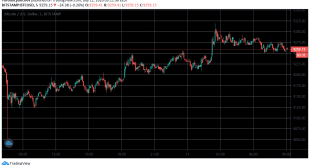

Bitcoin remains in its quite familiar range between $9,000 and $9,300 after a 2% increase from yesterday’s low.The most prominent US-based indexes registered similar increases yesterday, confirming the high correlation levels between the two asset groups.Bitcoin And Altcoins RecoverAs reported yesterday, the price for the primary cryptocurrency decreased to $9,050 on some exchanges like Bitstamp. On its way down, Bitcoin broke below the $9,300 level. The significant support at $9,000 confined...

Read More »Stellar Price Analysis: XLM Hits New Yearly High With 20% Daily Gains

Stellar jumped above a 12-month high following 21% daily gains.Against Bitcoin, it’s currently trading just below 1000 SAT.XLM/USD: Stellar Facing Channel’s Resistance Key Resistance Levels: $0.1, $0.135Key Support Levels: $0.0864, $0.077XLM/USD. Source: TradingViewStellar saw impressive growth over the past four days, with almost 33% gains since the beginning of the month. Meanwhile, it started to show positive signs after exhausting June’s bearishness at around $0.057, which is now holding...

Read More »Crypto Price Analysis & Overview June 19th: Bitcoin, Ethereum, Ripple, Crypto.com, and Stellar

BitcoinBitcoin saw a period of sideways movement over the past week as it dropped by a small 0.5%. The cryptocurrency has pretty much traded between $9,600 and $9,200 over the past seven days as it remains above the rising trend line support.So long as BTC can continue above this rising trend line, the bullish trend would be intact.Looking ahead, if the buyers push above $9,600, the first two levels of resistance lie at $9,815 and $10,000. Above this, additional resistance is found at $10,226...

Read More »After 35% Monthly Gains, Stellar (XLM) Looks Ready For The Next Move: Price Analysis

Stellar surged by a total of 36% over the past 30-days as it reaches the $0.070 level.The cryptocurrency is now holding the support at $0.066, and it remains above a rising trend line.Against Bitcoin, XLM suffered in May after falling from 850 SAT, but the bulls are in a battle to remain above the 700 SAT support.Key Support & Resistance LevelsXLM/USD:Support: $0.066, $0.061, $0.0588.Resistance:$0.071, $0.0757, $0.08.XLM/BTC:Support: 700 SAT, 680 SAT, 655 SAT.Resistance: 720 SAT, 750 SAT,...

Read More »Crypto Price Analysis & Overview May 1st: Bitcoin, Ethereum, Ripple, Stellar, and Chainlink

BitcoinBitcoin saw an impressive 17.5% price increase over the past 7-days of trading as the cryptocurrency managed to climb above the $7,500 resistance to break above $8,000. It continued to push higher and eventually reached a weekly high of $9,430 before dropping to the current resistance at $8,870 (1.272 Fib Extension).This price increase is not surprising because the Bitcoin block halving event is just a short 10-days away.If the buyers continue to push above the current $8,870 level,...

Read More »Bitcoin Ends The Week Touching $7700, Almost Fully Recovered From The COVID19 Crash: The Weekly Market Update

It’s safe to say that the last seven days were packed with action on all fronts. Bitcoin started the week trading at around $7,100 but fell to a low of around $6,800. The bears were for not, however, as yesterday BTC surged to a high of $7,780 in a few consecutive green candles. Naturally, the entire market followed with most of the large-cap cryptocurrencies charting serious weekly increases. Tezos is up more than 25% over the past four days while others like Ethereum, Chainlink, and Stellar...

Read More »XLM Sees New Monthly Highs At $0.0625 And Shows Strength Against Bitcoin. $0.07 Next? Stellar Price Analysis & Overview

Stellar reactivated a mid-term bullish trend following a 17% increase over the last 24-hours trading.After breaking out from a monthly resistance, XLM continued to increase and reclaimed last month’s high – $0.0618Stellar is now targeting 8-month resistance following a monthly recovery from 600 SAT support levelXLM/USD: Stellar Reactivates Bullish Above Monthly HighKey Resistance Levels: $0.0665, $0.07Key Support Levels: $0.0618, $0.053XLM/USD. Source: TradingViewAfter bouncing back above...

Read More » Crypto EcoBlog

Crypto EcoBlog