The US Securities and Exchange Commission (SEC) has come to a settlement with the company behind one of the largest initial coin offerings of 2017 and 2018, Block.one. EOS raised a total of billion, and the firm will pay a fine of million for running an unregistered ICO.Block.one to Pay M FineThe SEC has reached a settlement with the creator of EOS, Block.one. According to the agency, the company must pay a fine of million for running an unregistered ICO. That’s because ICOs qualify as securities offerings and EOS failed to seek an exemption from registration requirements.According to the co-director of the SEC’s Division of Enforcement, Steven Peikin, Block.one failed to provide investors with the information to which they were entitled as participants in securities

Topics:

George Georgiev considers the following as important:

This could be interesting, too:

Guest User writes Join the Future! ZacroTribe (ZACRO) Presale Opens Soon at %related_posts%.01!

Guest User writes The Future of Financial News Presale is Here: Secure Your ZACRO Tokens for a New Era of Decentralized Insights

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

The US Securities and Exchange Commission (SEC) has come to a settlement with the company behind one of the largest initial coin offerings of 2017 and 2018, Block.one. EOS raised a total of $4 billion, and the firm will pay a fine of $24 million for running an unregistered ICO.

Block.one to Pay $24M Fine

The SEC has reached a settlement with the creator of EOS, Block.one. According to the agency, the company must pay a fine of $24 million for running an unregistered ICO. That’s because ICOs qualify as securities offerings and EOS failed to seek an exemption from registration requirements.

According to the co-director of the SEC’s Division of Enforcement, Steven Peikin, Block.one failed to provide investors with the information to which they were entitled as participants in securities offerings. Stephanie Avakian, another co-director, said:

A number of US investors participated in Block.one’s ICO. […] Companies that offer or sell securities to US investors must comply with the securities laws, irrespective of the industry they operate in or the labels they place on the investment products they offer.

Block.one has agreed to pay the fine while neither admitting nor denying the government’s findings.

What Now?

Unfortunately, the SEC didn’t provide any clarification as to whether or not the issued token represented a security, but rather found that the procedure for its issuance qualified as a security offering.

As such, it is unclear whether or not EOS itself is a security in the eyes of the commission. However, the SEC’s decision has certainly raised quite a lot of questions within the cryptocurrency community.

Number one, of course, concerns the amount of the fine. EOS raised around $4 billion during its token sale and the fine amounts to $24 million. Spun from a different perspective, one could say that Block.one’s ROI was around 16,500%.

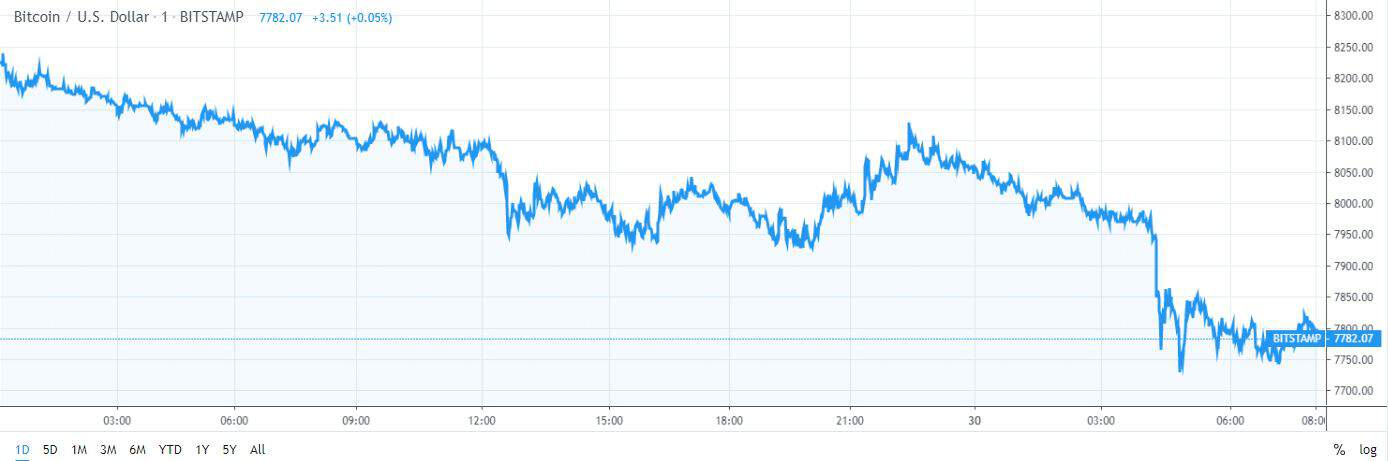

In any case, one thing is clear: EOS is pumping on the news. Over the past 24 hours, the price of EOS is up 9%, having broken back above $3.