A consumer watchdog has warned about the lack of transparency Tether exhibits in confirming the reserves backing its stablecoin and it ignoring the amount of crime USDT facilitates.

Non-profit organization Consumers’ Research has released a warning to alert the crypto community and everyone else of Tether’s lack of transparency in revealing the reserves backing its USDT stablecoin. This report comes after S&P Global rated it 4 out of 5 after a risk assessment, with 5 being the worst score achievable.

Consumer Research’s report calls Tether out through various accusations, including a lack of audit by third parties to confirm USDT tokens are backed appropriately. “Tether continually waves a bold red flag with its refusal to be independently audited, or to properly audit itself. Tether has

Articles by Suraj Manohar

Hong Kong Aims for New OTC Crypto Services Regulations

September 15, 2024If the new regime takes effect, the SFC will collaborate with the C&ED to oversee OTC services in Hong Kong.

Financial hub Hong Kong looks to introduce a new regime for over-the-counter (OTC) virtual asset trading services as the Securities and Futures Commission (SFC) conversed with multiple ‘industry participants.’ Should the jurisdiction proceed in that direction, the SFC will work with the Customs and Excise Department (C&ED) to better regulate the crypto industry.

A proposal from February suggested that the C&ED would solely oversee the OTC virtual asset vertical. However, industry stakeholders mentioned that giving the C&ED charge of OTC services is proving puzzling as the SFC deals with most things crypto. As the SFC looks to enter the OTC space, it is also conversing with crypto

Chainalysis Ranks India as the Top Nation for Crypto Grassroots Adoption

September 13, 2024India topped Chainalysis’ Crypto Adoption Index two years in a row, while the Indonesian crypto market made tremendous strides this year.

India has secured the first spot globally in the Chainalysis Crypto Adoption Index this year, followed by nations like Nigeria, Indonesia, the US, and Vietnam. This is the second time India’s grassroots crypto adoption has beaten every other country, as it also topped the index in 2023.

Chainalysis released its report on September 11, analyzing the adoption of the asset class in 151 countries. The adoption index for this year marks the fifth iteration, with the blockchain analysis firm doing the same consecutively for the past four years. The adoption metrics were calculated over various segments, including value received by centralized exchanges (CEXs)

ParaFi Leverages Tokenization Using Avalanche and Securitize

September 13, 2024ParaFi’s tokenization of its fund represents the company believing in the technology it invests in and eating its “own dog food.”

Digital asset management firm ParaFi is tokenizing a portion of its portfolio, worth $1.2 billion, on the Avalanche blockchain using the tokenization platform Securitize. Through partnering with these platforms, which ParaFi is an investor in, it will offer a minority stake in its most recent venture capital fund, which closed in May. Investors can get their hands on the token shares on Securitize.

“We decided we want to eat our own dog food,” Ben Forman said regarding the motivation to do this. “We are investors in this technology, but we didn’t just want to invest in the tokenization infrastructure, we wanted to use it ourselves.” He also indicated that this

Will Turkey’s $205 Ceiling on Cash Payments Affect Crypto

September 13, 2024If this goes through, Turkish citizens transacting more than $205 in the country will be fined 10% of the transacted amount.

Turkey plans to impose a limit on cash payments and is considering imposing a 10% fine on anyone spending more than 7,000 Turkish liras ($205). The Turkish Revenue Administration started taking suggestions for the draft amending the General Communiqué of the Tax Procedure Law No. 459. The amendments place a $205 barrier to cash payments, leaving individuals and businesses to transact amounts greater than that through banks.

“The Revenue Administration (GİB) opened the Draft Communiqué on Amendments to the Tax Procedure Law General Communiqué (Sequence No: 459) to public opinion,” a translated version of a post published by Turkish media page BPT Haber read. “If the

Tether, Tron, and TRM Labs Join Hands to Launch the T3 Financial Crime Unit

September 11, 2024The T3 Financial Crime Unit will work to reduce criminal activity associated with USDT on Tron, collaborating with law enforcement agencies to hold criminals accountable and make victims whole.

The largest stablecoin issuer, Tether, Justin Sun-created Tron, and blockchain intelligence platform TRM Labs have collaborated to launch the T3 Financial Crime Unit (T3 FCU). The alliance will allow Tether to identify and report crime-related USDT transactions on the Tron network.

The Majority of USDT in Supply Circulates on Tron

Tron houses the largest number of USDT tokens out of any blockchain, with over $60.7 billion worth of USDT circulating on the network. That amounts to 51% of all USDT supply, which stands at a whopping $118 billion. Furthermore, 45% of all illicit crypto fund flow occurred

Polygon Upgrades MATIC to POL, Integrates More Features to the New Native Token

September 7, 2024Polygon’s anticipated native token upgrade is here, marking a critical milestone for the Polygon 2.0 vision.

The Polygon network successfully introduced its new native asset, POL, in a much-awaited move for the blockchain’s users and onlookers. With that, POL has replaced MATIC—the network’s native asset since its genesis. MATIC holders can claim POL 1:1 if their holdings have not already been converted to POL.

In an X post, the official Polygon account explained, “There is no deadline for users to upgrade. All MATIC on Polygon PoS & staked MATIC on Ethereum will upgrade automatically on Sept 4.” Those holding MATIC linked to Ethereum in their wallets must visit the Polygon Portal Interface to swap for POL using the migration contract. Those holding the token in their centralized exchange

Hacker Behind $27 Million Penpie Attack Receives Compliment From Counterpart

September 7, 2024The individual behind 2023’s $195 million Euler Finance hack appreciated the Penpie hacker for steadfastly funneling funds via Tornado Cash and showing no indication of returning the proceeds.

A hacker whose efforts led to the recent $27 million Penpie protocol attack received a compliment from another hacker in the spotlight last year for exploiting Euler Finance. The Penpie hacker hit the protocol on September 3, making away with their illicit proceeds.

They funneled about $7 million of the stolen funds through Tornado Cash within 12 hours to cover their tracks. Further reporting from blockchain security firm PeckShield indicated the address moving over $23 million to Tornado Cash on September 6.

The Euler Finance hacker chimed in as the situation unfolded, leaving an on-chain message

MEV Bot Executed a $12 Million Flash Loan to Make Only $20

September 7, 2024An MEV bot conducted 14 transactions in a single block to launch a sandwich attack on an unsuspecting user to only net $20 in profits.

A Maximum Extractable Value (MEV) bot found an opportune moment to execute a $12 million flash loan to conduct a sandwich attack on an unsuspecting user. However, the ordeal only netted it a meager $20 in profits after gas fees through the flash loan exploit.

The incident offered comic relief to many in the crypto community during a period when high-profile hacks and attacks are occurring frequently. Arkham Intelligence brought the successful yet failed attack to light. “An MEV Bot just took out a $12 Million flashloan to make less than $20 in profit,” Arkham mentioned in an X post. “It sandwiched a user trying to swap $5K of SHFL to WETH using around 2%

Penpie Hacker Who Stole $27 Million Funneled Over $7 Million Via Tornado Cash in 12 Hours

September 4, 2024The hacker stole $27 million from Penpie as the project’s developer acted swiftly to prevent at least another $105 million from being lost.

A hacker plundered $27 million from DeFi protocol Penpie and funneled $7 million through crypto mixer Tornado Cash in less than 12 hours. The hack occurred on September 3.

Blockchain security firm Cyvers alerted Penpie and the community of the hack on September 3. “Hey @Penpiexyz_io, Our system has raised multiple suspicious transaction(s) involving your contract!” It added, “Affected tokens are $wstETH, $sUSDe, $rswETH.”

Source: Cyvers Alerts on X

It followed up this post with an update about the hacker trying to obfuscate their footprints using Tornado Cash. @Penpiexyz_io exploiter has deposited around $7M to @TornadoCash.” Another security firm,

Justin Sun Implements 100% On-Chain Buyback and Burn Mechanism for SunPump

September 4, 2024The SunPump community changed its mind about an LP burning mechanism, instead opting for an on-chain buyback and burn mechanism, which Justin Sun agreed to.

After hearing the SunPump community out, Justin Sun has decided to implement a 100% on-chain buyback and burn mechanism for the SUN token, memecoin generator SunPump’s native asset. While the initial decision was to integrate an LP token burn mechanism, the community decided against it for various reasons, pushing Sun to choose the alternate method.

“After discussion, the community agreed that a better approach would be to directly implement a 100% on-chain buyback and burn process,” the Tron founder announced on X. “This method is easier to verify, as all fund burn records will be on-chain, making it straightforward and eliminating

DeFi Protocol Threshold Wants to Merge with WBTC

September 3, 2024Threshold has proposed a merger of its tBTC token with WBTC as the industry is concerned for the latter’s future.

Threshold, a protocol offering a decentralized version of wrapped bitcoin through its tBTC token, has proposed a merger with BitGo’s WBTC token in an effort to “save” the biggest wrapped bitcoin token by market cap. WBTC’s future has become concerning for the crypto community after BitGo partnered with Hong Kong-based BiT Global to expand its foothold beyond the United States.

BiT Global is partly owned by Justin Sun and the Tron ecosystem, bringing massive worries to WBTC holders and DeFi protocols relying on the token for various purposes. For instance, MakerDAO approved a proposal to stop WBTC from being accepted as collateral and close all debts on the platform

Binance Executive Detained in Nigeria Seeks Bail Amid Worsening Health

September 3, 2024Binance’s head of financial crime compliance and former federal agent Tigran Gambaryan was brought to court as his trial resumed on September 2 after over a month of Nigerian court holidays. His trial was initially slated to resume in November but was pushed ahead to this month.

Gambaryan’s legal counsel motioned to have him out on bail due to worsening health conditions. The opposing counsel fired back at the claims, asking the judge not to grant Gambaryan bail as they feel his health is sound. His medical records say otherwise, showing that he requires surgery. However, his family has stated that crucial medical reports were missing, including MRI scans. Moreover, his records were submitted months after the court had asked the prison to do so. Even more concerning is how the detainment

Qatar Launches Crypto Regulatory Framework

September 3, 2024The Middle East is making strides in crypto adoption and regulatory development. Qatar now adds to that by introducing a comprehensive digital assets framework. More specifically, the regulations were introduced in the Qatar Financial Centre (QFC) by the Qatar Financial Centre Authority (QFCA) and Qatar Financial Centre Regulatory Authority (QFCRA).

Like the UAE’s multiple free zones, the QFC is an independent economic zone aimed at fostering businesses and innovation in various fields. It allows 100% foreign ownership of businesses and charges a low 10% tax, making it attractive for all kinds of ventures. With digital assets regulations in place, Web3 businesses can now take advantage of the economic zone and set up shop here.

“Launching the 2024 Digital Assets Regulations marks a

Bitcoin Miners Observe the Worst Month in Close to a Year

September 2, 2024Bitcoin miners made the lowest revenues in August since September 2023 as the network’s mining difficulty peaked at the highest it has ever been on August 31.

August marked the worst month in revenues for Bitcoin miners this year and since September 2023. They mined a total of $827.56 million last month following a trend of reducing mining rewards since April’s halving event that reduced block rewards to 3.125 BTC. August’s revenues saw a 10.5% reduction from July when miners netted $927.35 million. However, the rewards were up 5% from August 2023 due to the slump the crypto market and BTC found themselves in.

Nevertheless, to keep with BTC’s better price action this year, the August revenues declined by 53% compared to the network offered to miners in March 2024, when it netted them $1.3

Telegram’s Revenues Driven by Crypto, Holds $400 Million Worth of Digital Assets in Its Balance Sheets

September 2, 2024The Financial Times (FT) received Telegram’s financial statements, which reveal how intertwined digital assets are for the company’s revenues and worth.

A Financial Times report dived into the financial health of Telegram, as the company has been the talk of news cycles with the arrest of its founder, Pavlov Durov, in France. It revealed the importance crypto plays in the firm’s financial health through various methods, including asset appreciation and revenues.

Crypto Runs Deep in Telegram’s Gains, Revenues, and Net Worth

For starters, Telegram’s profit and loss (PnL) statement from 2023, signed by Durov and audited by PwC, showed gains of $500,000. While that is modest, it does not account for the gains made via the revaluation of digital assets due to accounting guidelines. Telegram

$313 Million in Crypto Lost to Hacks in August

September 2, 2024August marked a worrying time for the industry as cybercriminals ransacked hundreds of millions of dollars.

With the number of hacks and scams rising tremendously this year, August marked another bad month in terms of the amounts lost to cybercriminals. August witnessed about $313 million scammed from crypto holders and platforms.

Blockchain security firm PeckShield shone a light on this, stating, “August 2024 witnessed 10+ hacks in the crypto space, resulting in ~$313.86 million in losses. The 2 largest hacks, both involving unauthorized transfers (#Phishing), accounted for 93.5% of the total stolen funds, amounting to $293.4 million.”

Source: PeckShield on X

One of those phishing attacks saw cybercriminals walk away with a whopping $238 million in BTC. The other stole $55.4 million in

Vitalik Buterin Accused of Selling ETH for Profit, Denies Claims

September 2, 2024Crypto circles on X accused Buterin of selling ETH for profits. Many defended him as he denied the allegations.

Ethereum co-founder Vitalik Buterin moved large sums of ETH, causing some crypto users to call him out for his actions. He denied the claims of profiting from the selling, mentioning the proceeds were for funding projects he believed in and other charitable initiatives.

A crypto user on X accused him of selling over $2 million worth of ETH on August 30 after he published a bullish post on the platform. “Vitalik once again talking about random technical stuff and ignoring all the talk about him selling ETH,” wrote user @coinmamba.

Blockchain analytics firm Lookonchain mentioned he also sent $8 million to the same wallet earlier that month. “On Aug 9, #Vitalik also transferred

Maker Rebrands to Sky, Replaces DAI With USDS Causing Worry Over Freeze Function

August 29, 2024Household DeFi protocol Maker replaced its decentralized DAI stablecoin with centralized USDS as it rebranded to Sky. Users are not happy.

DeFi lending protocol, Maker, came out of its rebranding efforts as Sky. With that, Maker’s stablecoin, DAI—the largest decentralized stablecoin in the crypto ecosystem—was replaced by the new USDS. Maker’s MKR governance token also saw an upgrade as the rebranding ushered in the SKY governance token.

Sky’s team suggested the rebranding will help take this protocol to the next level and drive adoption to users who have not leveraged the benefits of DeFi yet. For instance, Sky looks to attract centralized exchange (CEX) users with its new stablecoin, which will be backed by US treasury bills. In comparison, the previous iteration, DAI, was backed by

Circle Addresses Bug That Could Have Led to Millions in Losses if Exploited

August 29, 2024Attackers could have minted up to 35 million USDC on the Noble Bridge if Asymmetric Research had not found the flaws.

Asymmetric Research, a blockchain cybersecurity firm, helped Circle identify a bug that could have led to massive losses if not addressed. It existed in Circle’s Cross-Chain Transfer Protocol (CCTP) deployed on the Cosmos network, which allows the firm’s USDC stablecoin to be bridged. Specifically, Asymmetric found the vulnerability in the noble-cctp module of the CCTP.

“We privately disclosed a vulnerability to Circle via their bug bounty program,” the security firm said in its report. “Notably, no malicious exploitation took place, and no user funds were lost. Circle promptly took action, once notified, to fix the bug.”

The bug could have allowed bad actors to mint

WazirX Files for Moratorium in Singapore Court

August 29, 2024WazirX said it would take at least six months for the restructuring to occur, after which its users would receive their deposits.

The exchange maintains that this approach is the best route for all parties involved.

Indian exchange WazirX filed for a moratorium in the Singapore High Court on August 27 under its parent company, Zettai Pte, registered in the city nation. The move comes as the exchange restructures its liabilities under the Singapore Scheme of Agreement after having over $230 million stolen by hackers in July.

The moratorium, if granted by the court, will offer WazirX “breathing space while Zettai progresses with a restructuring, which represents the most efficient way to address users’ cryptocurrency balances on the Platform and facilitate recovery for users,” it said in an

Base Surpasses 1 Million Daily Active Wallets

August 28, 2024Base reaches the 1 million daily active wallet milestone.

It recently surpassed 4 million weekly active wallets.

The Coinbase-launched Ethereum layer-2 Base has witnessed an amazing month in terms of adoption, hitting various milestones to now witness over 1 million daily active wallets. This recent development comes thanks to the “Basenames” service, which has spurred tremendous usage over the past few days.

Base crossed the threshold on August 24 as 1.05 million wallets interacted with the layer-2. It has since dropped but can rise again, considering the numerous developments unfolding on the layer-2. Nevertheless, last week’s growth amounted to a whopping 60% since August started. This uptrend puts Base at the top of the Ethereum layer-2 ecosystem. Its daily usage is followed by

Cyberattacks on French Government Ensue After Telegram CEO Arrest

August 28, 2024Hacker groups are preventing user access to websites belonging to French authorities to show their support for Pavel Durov.

Durov was arrested on August 24 by French authorities.

Russian hackers are staging Distributed Denial of Service (DDoS) attacks on the French government’s website in response to the August 24 arrest of Telegram CEO Pavel Durov. He was arrested in France for alleged involvement in money laundering, drug trafficking, and more crimes, but no formal charges have been issued yet.

A Slew of DDoS Attacks

A cybersecurity expert, Clément Domingo, known on X as SaxX, posted about ten websites experiencing downtimes due to DDoS attacks under the name ‘opDurov.’ A translated version of the post read, “hacktivist groups have been attacking various French sites since midday.” It

Binance Executive Jailed in Nigeria Will Come Back to Court Next Week, CEO and Family Ask for Release

August 28, 2024Tigran Gambaryan’s health has steadily declined throughout his detainment in a Nigerian prison since February.

Binance’s CEO and Gambaryan’s family have voiced their concerns about the “irreversible physical and mental impact” on his health and his “reaching the point of no return.”

Tigran Gambaryan, Binance’s head of crime compliance, will be brought back to court on September 2 as his trial for money laundering resumes. The court initially set a hearing for October 11, but defense lawyers convinced it to move it ahead to next week, according to Gambaryan’s family.

He has remained in prison for the last six months after his arrest in February. More specifically, the Kuje Prison—a facility known to house the most notorious criminals, including members of the terrorist group Boko Haram.

India’s CBDC Program Has Now Surpassed 5 Million Users

August 27, 2024India’s CBDC has attracted 5 million users and 16 banks.

The RBI is in no rush to launch a full-scale CBDC program yet.

India’s CBDC program has onboarded at least 5 million users and witnesses participation from 16 banks, revealed Shantikanta Das, the Governor of the Reserve Bank of India, the country’s central bank. In his talk on Monday in the Indian city of Bengaluru, Das mentioned the magnitude the program has grown to, but made the RBI’s stance on taking it slow clear.

“It is important to emphasise that there should not be in any rush to roll out system-wide CBDC before one acquires a comprehensive understanding of its impact on users, on monetary policy, on the financial system and on the economy,” Das mentioned. “Actual introduction of CBDC can be phased in gradually.”

The first

Bitcoin Layer-2 Stacks Set to Receive Its Nakamoto Upgrade, Will Enhance DeFi on Bitcoin

August 27, 2024Bitcoin layer-2 Stacks will receive a highly anticipated upgrade on Wednesday, augmenting its transaction confirmation time.

The DeFi ecosystem built on Bitcoin is set to receive a massive boost from Stacks’ Nakamoto upgrade.

Stacks—a layer-2 Bitcoin network—will receive its latest upgrade, called Nakamoto, on Wednesday, August 28. With that, the Bitcoin community can witness high execution DeFi use cases unknown to the Bitcoin network.

That will occur due to the numerous capabilities this upgrade will unlock. The upgrade will bring massive scalability to Stacks. Thus far, the layer-2 could settle transactions between 10 to 30 minutes of their initiation. That is on par with the layer-1 Bitcoin network. After Nakamoto kicks in, settlement times on Stacks will drop by about 100x to

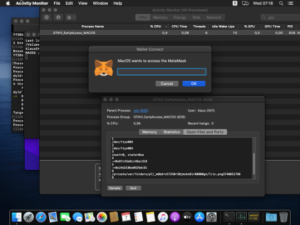

‘Cthulhu Stealer’ Identified to Grab Wallet Details From Mac Users

August 27, 2024Cthulhu Stealer attacks Mac devices and steals credentials from a long list of crypto wallets.

Malware aimed at draining funds from crypto wallets installed on Macs is rising.

A new malware called Cthulhu Stealer targets devices with MacOS to steal crypto wallet information, marking yet another malware affecting users of Mac devices. Cado Security identified the new malware and published a report detailing how it grabs wallet data. This has come to light days after reports of another malicious program, AMOS, manipulating the Ledger Live software application for Mac emerged.

“For years there has been a general belief in the Zeitgeist that macOS systems are immune to malware,” the report read. “While MacOS has a reputation for being secure, macOS malware has been trending up in recent

Indian Government Will Engage With Industry Stakeholders to Draft a Consultation Paper for Future Legislation

August 26, 2024The Secretary of the Department of Economic Affairs will draft a consultation paper by collaborating with Indian crypto stakeholders.

Crypto regulations are much awaited by industry participants in India owing to its high adoption rate.

The Indian government is engaging with crypto stakeholders to draft a consultation paper. That will help it develop its long-awaited regulations for the asset class. This approach of consulting stakeholders from the industry will allow the government to address crucial concerns and create a vast arching framework, leaving nothing ambiguous.

A report published by CNBCTV 18 last week broke the news, mentioning the Secretary of the Department of Economic Affairs (DEA) would take charge of the consultation paper. It is set to be out between September and

FTX Reorganization Plans Challenged by US Trustee and Creditors

August 26, 2024Andrew Vara, a US trustee, has pointed out flaws in the FTX reorganization plan.

A group of creditors also asked for the FTX estate to change the mode of repayment to cryptocurrency.

A US trustee has challenged the current FTX reorganization plan. Alongside the trustee, Andrew Vara, a group of creditors have also asked for better reorganization to meet its needs. While about 95% of FTX creditors voted for the path the FTX estate has taken, these objections may warrant it to look into its plan again to better help all parties involved.

Andrew Vara shone a light on multiple concerns, including the level of legal impunity given to the estate’s administrators and advisors. “Pragmatically, such immunity would negate the exceptions for gross negligence, willful misconduct, and fraud. Further,

WazirX Blames Unnamed External Parties for Delay in Its Restructuring Process

August 25, 2024Indian exchange WazirX took shots at certain unnamed entities, accusing them of making it harder for the exchange to start its restructuring process.

The process will allow the exchange to refund users appropriately while securing their assets simultaneously.

As the effects of the WazirX hack from July carry on, preventing its users from withdrawing their crypto, the exchange announced a restructuring plan on August 23. It also stated users could withdraw their INR (Indian Rupee) deposits in a phased manner from August 26 with a 60% discount on the withdrawal fees.

However, the platform took to X today to announce that the restructuring plan it is proceeding with is being delayed due to external parties. It has not named them yet. “Unfortunately, there are external parties, not invested