They say crypto’s biggest appeal lies in how fast one can acquire ‘Lambos,’ fly ‘to the moon’ and get their ‘numbers to go up.’ The Lambo aspect is still relevant as folks are making insane money day in and day out. The other two, not so much.Although traders still bet on prices of Bitcoin, Ethereum (ETH), and other crypto assets, cryptocurrency trading or investing is not the set method for generating humongous wealth presently. DeFi’s yield farming has taken the centre stage in the quest to...

Read More »DeFi Risks: CREAM Finance Crashes 70% in 3 Days As Devs Find Liquidity Pool Code Error

Popular DeFi protocol Cream Finance’s staking mechanism has stopped working because of an input error in its smart contract, which has increased the distribution speed ten-fold.At the same time, the Cream Finance (CREAM) token continues plummeting in value and is down by 50% in the past 24 hours alone.Cream Finance’s Tech ProblemThe DeFi protocol took it to Twitter to explain the technical difficulties it’s experiencing. The crCREAM Staking was stopped “for maintenance due to an input...

Read More »DeFi Protocol bZx Hacked Again: $8 Million Worth of ETH, LINK, Stablecoins Drained (Updated)

In yet another jolt to the decentralized finance (DeFi) community, margin, and leverage-based lending and trading platform, bZx became the target of another hack. In the hack, which was much bigger than the previous attacks, hackers made away with $8 million worth of cryptocurrencies.bZx Hackers Deal 8 Times More Damage To The DeFi Protocol This TimeDeFi lending protocol bZx was attacked again. This time hackers drained a little more over $8 million worth of cryptocurrencies leveraging a...

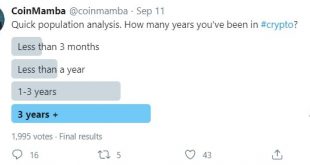

Read More »New Blood: 10% Admit They Joined Crypto In The Past 3 Months

The majority of voters in a recent poll have indicated that they had entered the cryptocurrency space more than three years ago. In contrast, 9.4% said that they had come around in the past three months during the DeFi boom.43% Crypto VeteransAlthough the cryptocurrency community emerged relatively recently with Bitcoin’s creation in 2009, it’s a continuously growing field that attracts new participants with its unique features. A recent poll aimed to shed some light on when the voters had...

Read More »Who Is Behind BurgerSwap? Already $400 Million BNB Staked in 1 Day Via Binance Smart Chain

As the DeFi space continues to boom, developers have come up with yet another iteration of a Uniswap-like automated market maker. Zeroing down on the meme-based food token craze, the platform is called BurgerSwap. BUIDL it, and they come. I do not know who built this one, but it’s already live on #BSC.BurgerSwap https://t.co/hsFQCZ8bcq— CZ Binance (@cz_binance) September 12, 2020BurgerSwap, unlike SushiSwap or other alternatives, is based on the Binance Smart Chain. It’s an implementation of...

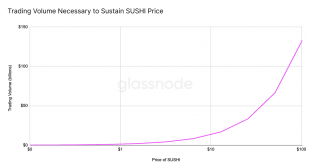

Read More »SUSHI Holders Beware: The Token’s Fair Value Is 85% Below Current Price, Claims Glassnode

Although SushiSwap’s protocol is already active and attracted over a billion worth of liquidity, a Glassnode analyst said that its governance token SUSHI is still highly overvalued. By exploring the economics behind SUSHI’s value, he outlined a fair price of $0.31 per coin.SUSHI (Still) OvervaluedLaunched as a Uniswap fork less than a month ago, SushiSwap took the DeFi world by storm. What gasped massive attention was the introduction of a governance token called SUSHI. This lured investors...

Read More »From 2-Man Team to The Leading Crypto Aggregator in 2020’s DeFi Craze: CoinGecko’s Story (Exclusive Interview)

CoinGecko is, without a shred of doubt, one of the largest cryptocurrency data aggregators. The index has shown impressive growth over the past year following a renewed interest in cryptocurrencies as the total market cap grows in 2020.Data from SimilarWeb shows that CoinGecko has hit a considerable number of almost 25 million users in August alone.It’s safe to say that it’s one of the veteran crypto venues and a household name for the industry. CryptoPotato had the chance to reach Bobby Ong,...

Read More »Bitcoin Struggles At $10,400: Binance Coin (BNB) Spikes To 7-Month High (Sat’s Market Watch)

Bitcoin continues to trade in the five-digit territory and even spiked towards $10,400. Binance Coin (BNB) is among the best performing tokens today, while most other larger-cap alts are marking minor gains.Bitcoin Struggles At $10,400After the unsuccessful attempt to overcome $10,500, Bitcoin dived yesterday and bottomed at about $10,200. However, the bulls interfered at that point and didn’t allow any further declines.In the following hours, BTC fluctuated in a tight range between $10,250...

Read More »This Crypto Project Soared 220% Because of Ethereum’s High TX Fees

Recent heavy congestion on the Ethereum blockchain appears to have had a beneficial knock-on effect for one cryptocurrency project in particular.Loopring (LRC) is a protocol for building non-custodial decentralized exchanges (DEXs) on Ethereum. It is also one of the few projects currently placed ahead of the curve thanks to its use of zk-rollup technology, which scales Ethereum transactions from ~15/sec, to ~3,000/sec.It’s interesting to note, therefore, that the value of Loopring increased...

Read More »Bitcoin’s Endless Fight For $10K As Correlation With Stocks Increases: The Crypto Weekly Market Update

In terms of sheer price action, this week was rather sloppy. Bitcoin was trading at around $10,400 seven days ago, and it’s now indecisive around $10,300.During the week, things did get slightly more tumultuous as BTC dipped below $10K on a few occasions, reaching as low as about $9,800 on Binance. Many thought that this is when it would close the outstanding CME gap at $9,600, but Bitcoin recovered and remains largely indecisive.It’s worth noting, though, that the primary cryptocurrency is...

Read More » Crypto EcoBlog

Crypto EcoBlog